Many commentators argue that alternative legal provider market share is destined to grow. But I think it may be more limited than many suggest.

Introduction and Background

Numerous recent articles and blog posts cite the rise of alternative legal service providers, prompted in part by EY acquiring Riverview Law and UnitedLex deals prompted. And the Big Four remain on many minds; see, e.g., Should BigLaw firms worry about increasing competition from the Big Four accounting firms?, September 2018, ABA Journal.

Whether we call this category alternative legal service provider (ALSP), legal companies, alternative legal provider (ALP), managed legal services (MLS), or legal process outsourcing (LPO – the original appellation) matters little. All offer clients legal service delivery that differs from law firms. (Hat tip to Mark Cohen’s Legal Mosaic for popularizing the legal service delivery term) .

In a nutshell, all combine multidisciplinary teams, lower cost labor, process focus, and technology investment to deliver more value to clients than do law firms. That’s the argument and I generally agree with it. Nonetheless, I think that alternative legal provider market share may be limited. Here’s why…

Been There, Done That, and I Was Disappointed

In the early aughts, as a consultant, I advised legal process outsourcing providers. I was convinced LPO was the future. So much so that I joined the management team of one full time in 2007 and stayed four years. The company grew rapidly and customers were generally pleased.

LPOs were the darling of the press and blogs for several years. Forrester around 2008 predicted a $4 billion LPO industry by 2015 with 79,000 jobs. They were way off; I suspect total LPO revenue remains under $1B.

Lessons I draw from my alternate legal provider experience include:

- Buyers, both law departments and law firms, are very slow to change their buying behavior. I see little evidence that has changed today.

- Markets change in unexpected ways: the economic crisis caused US contract lawyer rates to plummet, wiping out a significant portion of the savings working offshore.

- When a company hires a lot of people with legal market experience, it begins to face the same challenges as law firms, for example, less than a full embrace of technology.

I am not criticizing LPO, just drawing conclusions from personal experience.

Law Firms Are Not Standing Still

I studied economics in college and like two latin terms I learned:

- Ceteris paribus means with other conditions remaining the same.

- Mutatis mutandis means the necessary changes having been made.

I fear that many of the discussions about alternative legal providers taking share implicitly assume ceteris paribus. The alternative continues growing and nothing else changes significantly. They discount steps law firms take to respond to alternate legal provider growth.

The real world is mutatis mutandis: market players respond to competition. Specifically, I see law firms making many changes:

- Building low cost business and legal service centers.

- Hiring staff attorneys to reduce labor cost.

- Deploying a new class of professionals for pricing and legal project management.

- Investing more in knowledge management.

- Deploying new classes of technology that boost productivity.

- Taking bigger risks on fixed fee deals.

The impact of these is uncertain but they show that law firms are not standing still. Even in an earlier era, that was true. For example, much of Big Law has ceded immigration work to lower cost, specialized firms.

Law firms have also responded by betting on innovation. Agains, the impact is TBD but the bets are placed. For a fabulous series of essays on innovation in the legal market, read Jae Um‘s 3-part article published at Prof. Bill Henderson‘s blog, Legal Evolution. Part 3 of 3 was published today (and links to parts 1 and 2): Legal Innovation Woes, Part III: Skill Shortage, Emotional Labor & Arrested Development. Many of the challenges that Um explains law firms face apply to a fair degree to alternative legal providers.

For another example of how law firms change, consider another item today (03 Sep 2018): a sponsored post at Artificial Lawyer, Legal Transaction Management Software is Finally a Thing. It discusses a fairly new category of software to manage deals. Uptake has been slow – no surprise – but this illustrates how firms are changing.

My thesis here is old, I’m just refreshing it. In 2012, an ABA e-zine published my article The Impact of Legal Process Outsourcing (LPO) You Might Not Have Noticed. I argued that the real story of LPOs may well be BigLaw’s adoption of the how LPOs operate, citing examples.

Alternative Legal Provider Share Has Largely Been Flat

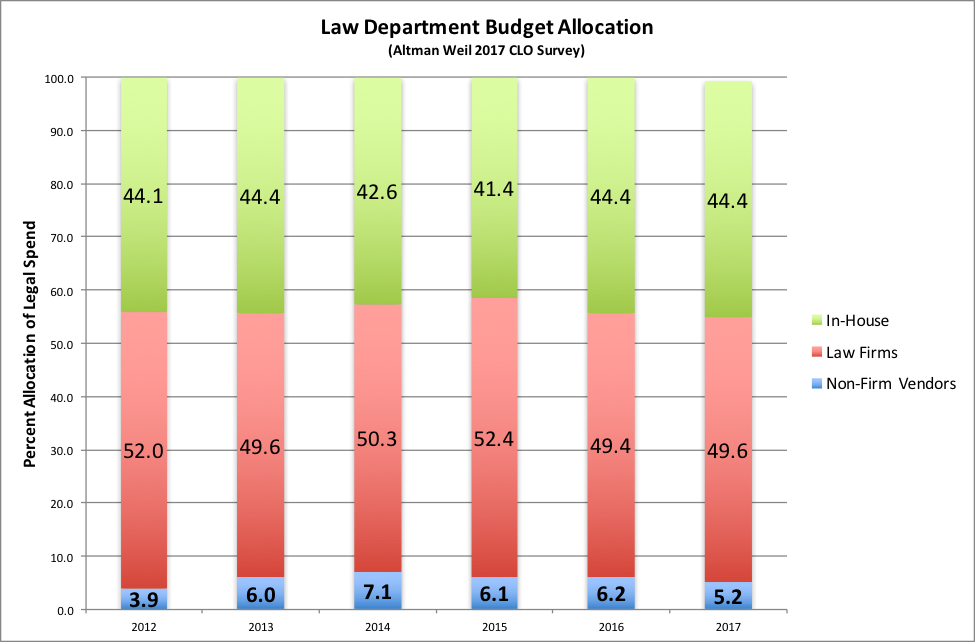

The only time-series data I have found about the alternative legal provider market share comes from the Altman Weil CLO survey. It shows flat if not shrinking share of client spend:

Consider a more recent data point: last week The Lawyer reported that Axiom Legal’s revenue is now $360M, which is up about 20% from one year ago. Impressive growth but how many other alternate legal providers grow that fast and how big is the total base?

Conclusions

We see many claims about alternate legal provider but little data. And conveniently little discussion of how law firms respond to competition. Arguably law firms see the slow uptake by their buyers and so feel no urgency to take more steps than they already are. On balance, the evidence I see suggests law firms are responding sufficiently. And that response likely will limit the market share gain of alternative legal service providers.

Archives

Blog Categories

- Alternative Legal Provider (44)

- Artificial Intelligence (AI) (57)

- Bar Regulation (13)

- Best Practices (39)

- Big Data and Data Science (14)

- Blockchain (10)

- Bloomberg Biz of Law Summit – Live (6)

- Business Intelligence (21)

- Contract Management (21)

- Cool Legal Conferences (13)

- COVID-19 (11)

- Design (5)

- Do Less Law (40)

- eDiscovery and Litigation Support (165)

- Experience Management (12)

- Extranets (11)

- General (194)

- Innovation and Change Management (188)

- Interesting Technology (105)

- Knowledge Management (229)

- Law Department Management (20)

- Law Departments / Client Service (120)

- Law Factory v. Bet the Farm (30)

- Law Firm Service Delivery (128)

- Law Firm Staffing (27)

- Law Libraries (6)

- Legal market survey featured (6)

- Legal Process Improvement (27)

- Legal Project Management (26)

- Legal Secretaries – Their Future (17)

- Legal Tech Start-Ups (18)

- Litigation Finance (5)

- Low Cost Law Firm Centers (22)

- Management and Technology (179)

- Notices re this Blog (10)

- Online Legal Services (64)

- Outsourcing (141)

- Personal Productivity (40)

- Roundup (58)

- Structure of Legal Business (2)

- Supplier News (13)

- Visual Intelligence (14)