I highlight here findings from the 2019 Altman Weil CLO Survey on ALSP (alternative legal service providers), legal operations professionals, and knowledge management. See also my post on the 2018 survey, where I focused on these topics as well.

The Chief Legal Officer Survey is one of the better legal market surveys. Altman Weil has run it since 2010, asking many of the same questions year to year, which provides better than usual longitudinal data in the legal market. Plus it has a good response rate, giving it additional reliability compared to other surveys.

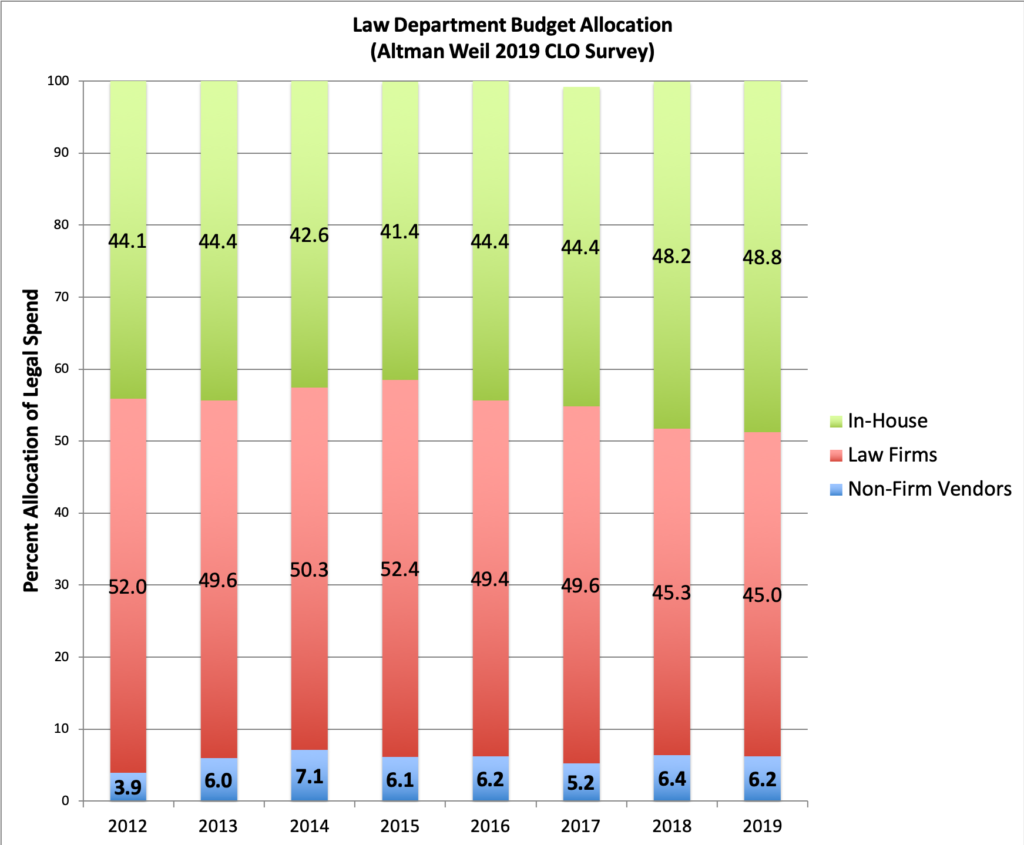

Share of Alternative Legal Service Providers (Law Companies) Remains Flat. I have previously written that ALSP share is not growing (see, e.g., Why Alternative Legal Provider Market Share May be Limited). The newest data confirms that ALSP share remains flat as a percent of client spend:

Other survey questions support this ALSP finding. One asks about steps law departments take to improve efficiency, offering 11 choices, including use more tech, better workflow, knowledge management (KM), and “outsource to non-law-firm vendors”. The outsource choice was second lowest at 12%. Compare that with the low, “None” at 10% and the high, more tech at 60%. Another asks about steps to control external spend; it also offers 11 options. For this one, the outsource response was also second lowest at 9%.

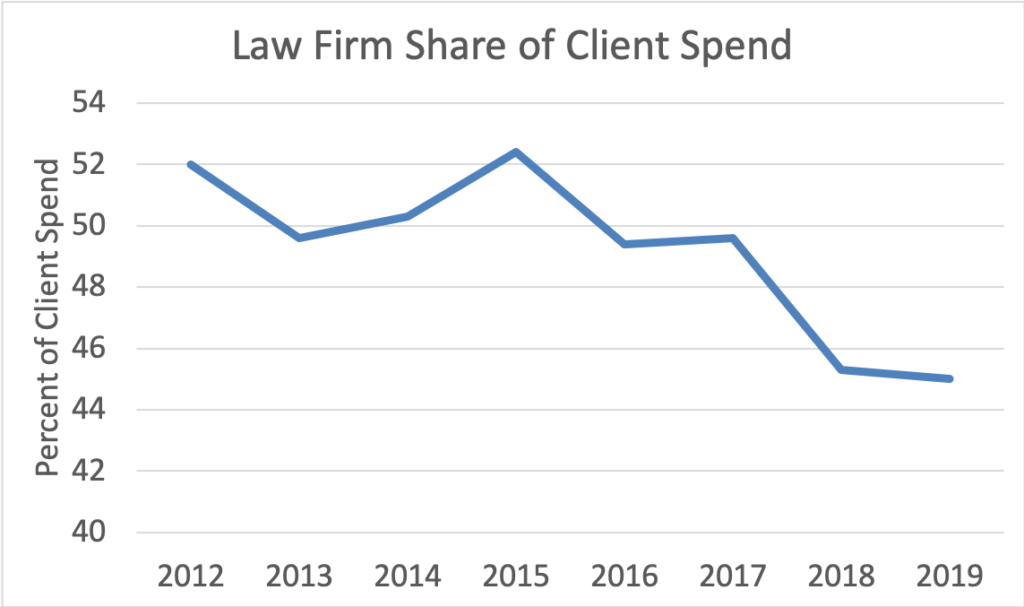

Law Firms Continue to Lose Share – To Their Clients.To make painfully clear data in the chart above, I pull out the law firm share of spend as a separate line. The almost continuous decline since 2012 is apparent:

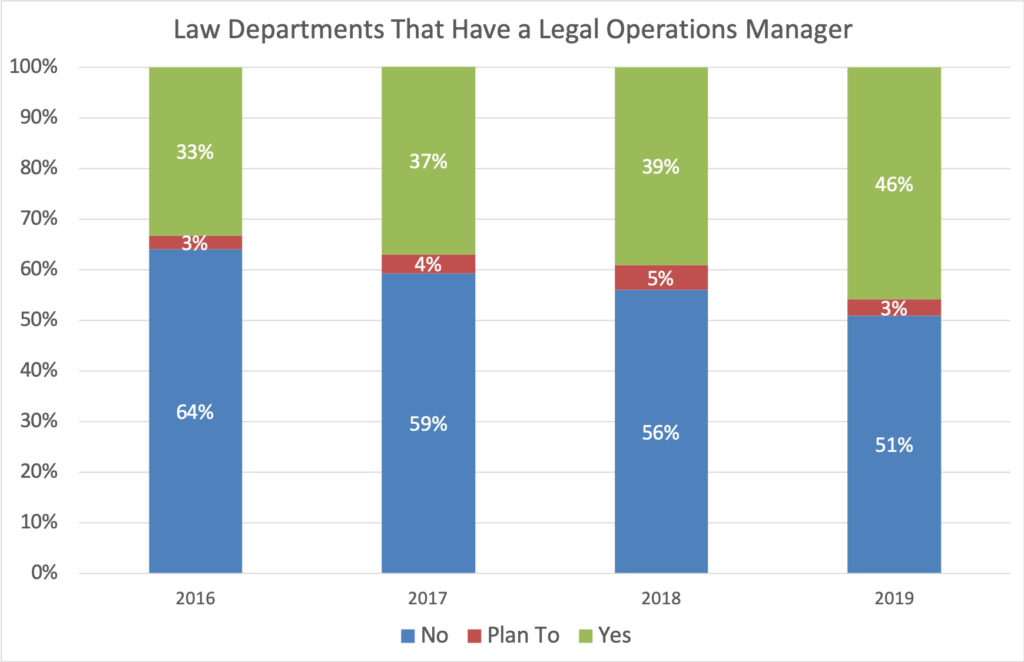

Legal Operations Continues to Grow. The survey asks CLOs if their departments have one or more legal operations professionals. The percent answering yes has grown again, at 46% in 2019.

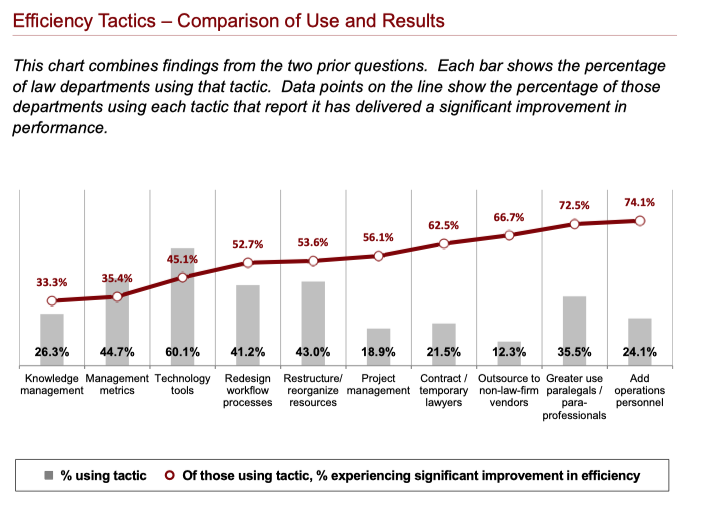

Law Departments Continue to Struggle with KM. Above I referenced a question that asks about law department efficiency tactics. Let’s focus here on the knowledge management answers. Though use of KM at 26% is roughly in the middle for popularity, it falls dead last in perceptions of actually improving efficiency. I have taken the liberty of reproducing a chart directly from the survey report. Focus the first bar, left-most, and the line above it.

Thoughts on the KM Finding. KM has not fared well in prior CLO surveys. Why does it receive lowest ranking for “experience significant improvement in efficiency”? I offer two potential reasons. First, it just may not work that well for efficiency. And second, law departments may not be doing it that well. I favor the second. Many law firms have grown their KM investments and others have started building out KM programs. The rise of KM in large firms suggest it offers benefits. I suspect that most law departments simply do not have enough resources to invest enough to make KM work properly. As a cost center, law departments have relatively little budget to invest in infrastructure. Law firms, in contrast, are profit centers, and where management thinks an initiative will help improve profit, it can fund investments.

Closing Thoughts. The survey is a rich source of data and insight. It covers numerous other topics for anyone interested in law department management, strategy, and tactics.

Archives

Blog Categories

- Alternative Legal Provider (44)

- Artificial Intelligence (AI) (57)

- Bar Regulation (13)

- Best Practices (39)

- Big Data and Data Science (14)

- Blockchain (10)

- Bloomberg Biz of Law Summit – Live (6)

- Business Intelligence (21)

- Contract Management (21)

- Cool Legal Conferences (13)

- COVID-19 (11)

- Design (5)

- Do Less Law (40)

- eDiscovery and Litigation Support (165)

- Experience Management (12)

- Extranets (11)

- General (194)

- Innovation and Change Management (188)

- Interesting Technology (105)

- Knowledge Management (229)

- Law Department Management (20)

- Law Departments / Client Service (120)

- Law Factory v. Bet the Farm (30)

- Law Firm Service Delivery (128)

- Law Firm Staffing (27)

- Law Libraries (6)

- Legal market survey featured (6)

- Legal Process Improvement (27)

- Legal Project Management (26)

- Legal Secretaries – Their Future (17)

- Legal Tech Start-Ups (18)

- Litigation Finance (5)

- Low Cost Law Firm Centers (22)

- Management and Technology (179)

- Notices re this Blog (10)

- Online Legal Services (64)

- Outsourcing (141)

- Personal Productivity (40)

- Roundup (58)

- Structure of Legal Business (2)

- Supplier News (13)

- Visual Intelligence (14)