Legal business operations, especially in corporate law departments, is on the rise. Lawyers in both law firms and law departments require an array of business and administrative support. That support makes a huge difference to legal cost, effectiveness, quality, and turnaround times. Yet operations receives less media coverage than, say, AI or law firm firm mergers.

I have long thought about legal operations and how best to support lawyers with both legal and business support. For example, that’s why I wrote The Future of Legal Secretaries (Legal Times) 14 years ago and went to work for a legal outsourcing provider (LPO) 10 years ago.

I was pleased that 2016 saw three reports on legal and business support operations. I summarize some key points and offer a bit of commentary on three reports that I found interesting. I close with a short view of where I see the 2017 opportunities.

Law Firm Shared Service Centers (ALM Report)

Shared Service Centers: Reshaping the Legal Marketplace and Saving Money (ALM, August 2016) surveys US and UK law firm onshore shared service centers. This is a topic I have followed since Orrick opened in Wheeling in 2003. I regret the report did not contrast the shared services center approach with outsourcing. Highlights:

- Significant Savings. ALM estimates moving work to a shared services center in a low cost location such as Tampa, Wheeling, or Kansas City can save 30% on labor and 40% on occupancy. These are in the ballpark of estimates I have seen personally and published elsewhere.

- Many Firms Have Centers. 25 onshore centers are open or have been announced for US and UK firms, half announced in the last three years.

- US Centers Focus More on Admin than Legal. “While there are exceptions, most onshore centers are focused on administrative functions such as finance, human resources and marketing. This is particularly true for US firms, which perform little legal work through their onshore centers.” I remain mystified why US law firms do not develop bigger staff attorney teams in their low cost centers.

- Admin Services Cover a Range of Support. The report lists numerous services performed in shared centers, including IT, HR, finance, marketing, conflicts, and KM. I am surprised that the report does not list document processing and production, which I know some centers do perform.

- Centralizing Reduces Staff Headcount Requirements and Improves Efficiency. ALM finds that the cost reduction of centralizing is “5% to 15% in back-office functions related to human resources, marketing, IT, and finance-related tasks.” The report also notes that if the move of positions is accompanied by process analysis and optimization, firms can recognize additional savings and efficiencies. In spite of US firms many rounds of cost-cutting, that process optimization strikes me as proverbial low hanging fruit.

Business Services Deep Dive (The Lawyer UK Survey with Applicability to US)

The Lawyer UK 200 Business Services – 2016 (November 2016) is one of the more detailed studies I’ve seen on law firm staffing. While UK firms can differ from the US, it is helpful for firms in both countries. Highlights:

- Wide Variance in Staffing Ratios. Staff to lawyer ratios vary widely. It would be interesting to know how much of the variation is based on differences in actual requirements and how much on accidents of history and culture. For example, the average number of fee-earners per secretary and document production specialist is 3.4. A histogram, however, shows the wide variation: 25% of firms are between 2 and 3; 30% between 3 and 4; and 15% between 4 and 5.

- Growing Importance of Tech. 85% of respondents say tech has move up the firm’s agenda and 66% report budget increases. 31% say they see a return on investment in tech spending, with some reporting clearly improved financial performance because of it.

- Innovation is the New Game. 55% of respondents report having an innovation team or separate R&D budget. As a long time legal tech and innovation enthusiast, I am pleased to see these results. I believe, however, that the full impact of more investment here requires that more legal work move to fixed fees. Performing legal work under fixed fees will, in well managed firms, drive interest in multiple means of improving lawyer efficiency (output per unit of time).

Law Department Operations (9th Annual Blickstein Group LDO Survey)

The Blickstein Group recently released its annual survey, Findings from the Ninth Annual Law Department Operations Survey (link to PDF). It provides insight into how law departments manage themselves. Highlights:

- Legal Project Management on the Rise. 57% or responding law departments, up from 50% two years ago, report having an LPM program. Of these, only 2.5% points report the program as “very effective” and 44% as “somewhat effective.” In my view, more law departments need LPM and they need to do it better.

- Metrics on the Rise as Well but Much Room to Improve. 63% report having formal metrics or reporting but effectiveness is low. On a scale of 1 to 5 (where 1 is primarily manual and 5 is fully automated with dashboards), the average is 2.1. To get more value from both in-house and outside lawyers, law departments must continue on the metrics past more rapidly.

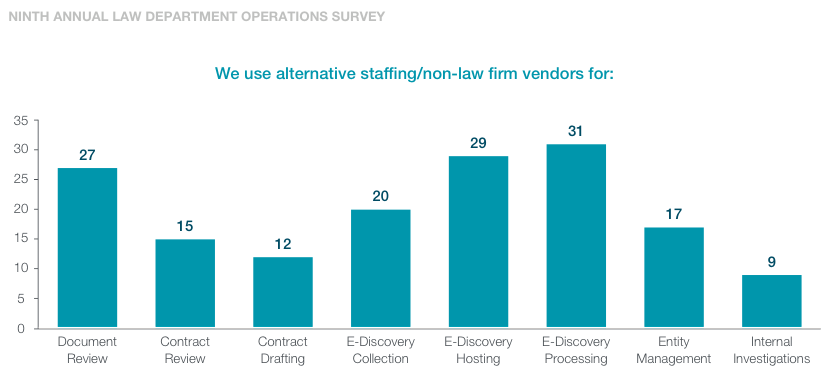

- Law Departments Continue to Use Alternatives to Law Firms. Law departments use providers other than law firms for a range of functions as the chart below shows. Legal process outsourcers (LPO) are one provider type doing this work: 21% of respondents use LPOs, up from 17% in 2015. These data are one explanation for the relatively flat growth of large law firms.

2017 Legal Operations Opportunities

Lawyers and legal organizations have many opportunities to improve operations. Law departments need to continue hiring directors of operations. With the help of LDOs, general counsel must develop – and more importantly, take action based on – metrics.

Both law firms and law departments can re-think how they support lawyers. The first stop is to examine processes and rationalize them: what needs doing, what does not; who should do it and why; and can automation reduce the burden. Low cost centers remain an option but require much planning and investment. Any reasonably large legal organization should, if it has not already done so, consider centralizing legal and business support. In that effort, consider opportunities to delegate to more junior and lower-cost staff, whether they are employees or an outsourced provider.

With some one-half of the personnel of both law firms and departments professionals other than lawyers, it’s time for legal business managers to pay more attention to the business and legal support functions.

Archives

Blog Categories

- Alternative Legal Provider (44)

- Artificial Intelligence (AI) (57)

- Bar Regulation (13)

- Best Practices (39)

- Big Data and Data Science (14)

- Blockchain (10)

- Bloomberg Biz of Law Summit – Live (6)

- Business Intelligence (21)

- Contract Management (21)

- Cool Legal Conferences (13)

- COVID-19 (11)

- Design (5)

- Do Less Law (40)

- eDiscovery and Litigation Support (165)

- Experience Management (12)

- Extranets (11)

- General (194)

- Innovation and Change Management (188)

- Interesting Technology (105)

- Knowledge Management (229)

- Law Department Management (20)

- Law Departments / Client Service (120)

- Law Factory v. Bet the Farm (30)

- Law Firm Service Delivery (128)

- Law Firm Staffing (27)

- Law Libraries (6)

- Legal market survey featured (6)

- Legal Process Improvement (27)

- Legal Project Management (26)

- Legal Secretaries – Their Future (17)

- Legal Tech Start-Ups (18)

- Litigation Finance (5)

- Low Cost Law Firm Centers (22)

- Management and Technology (179)

- Notices re this Blog (10)

- Online Legal Services (64)

- Outsourcing (141)

- Personal Productivity (40)

- Roundup (58)

- Structure of Legal Business (2)

- Supplier News (13)

- Visual Intelligence (14)