Should law firms fear losing clients? Many do already but just how much should they worry? The 2016 Altman Weil CLO Survey provides insight.

The report opens with worrying data:

53% of law departments say they shifted a portfolio of work worth $50,000 or more because of a client service issue; 41% switched to another firm in pursuit of lower fees; and 30% moved their work to a firm that was more effective in managing matters. (page iii)

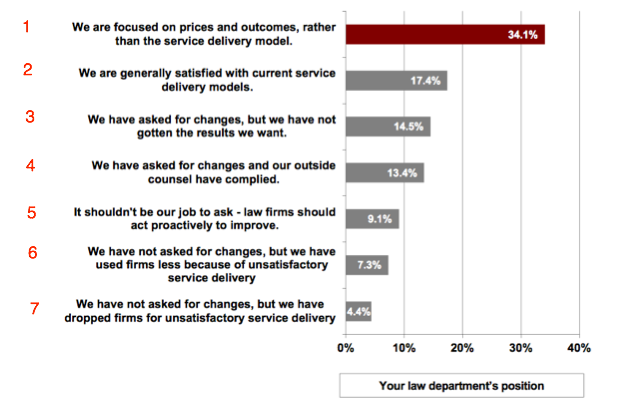

Answers to the 2016 bonus question illuminate client motivation and size the risk. Here are responses to the question, “Which of the following statements best reflects your law department’s position changing the way your outside counsel deliver legal services? (Choose one.)”:

By my read, 70% of clients are a flight risk.

In my view, only questions 2 and 4 do not represent risk of switching behavior (flight): “We are generally satisfied” at 17.4% and “We asked for change and got it” at 13.4%. That’s about 30%. The rest the answers represent the mindset of clients willing to switch firms.

What can law firm leaders do to minimize the risk of losing clients? The survey cites actions such as better client service, better legal expertise, lower fees, and managing matters more efficiently. (See page 13.) Many of my blog posts explain how lawyers can practice law more efficiently.

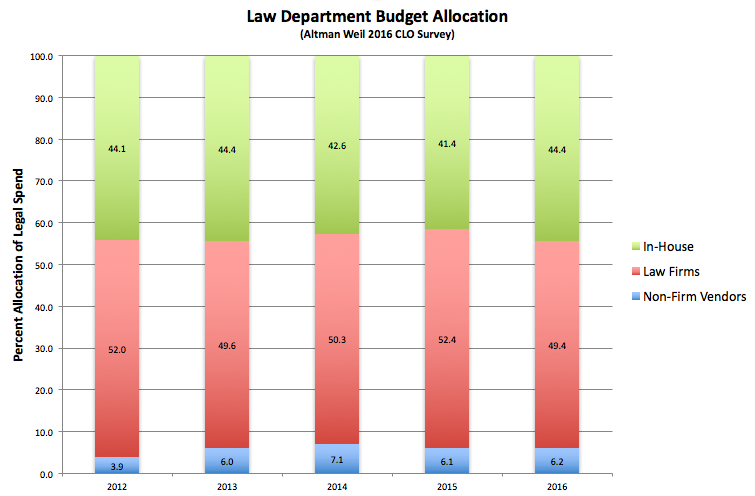

I close with further detail about flight risk: when law firms lose business, they lose mainly to competitors or clients. Many commentators, however, say alternative providers (non-law-firms) will eat law firms’ lunches. I don’t see it in the data: the chart below shows, for the last five years, the allocation of law department spending on alternate providers, law firms, and law departments. The share of non-firm vendors since 2011 averages 6.5% with little change. If alternative providers were growing rapidly relative to law firms, we would see this percentage increasing.

Archives

Blog Categories

- Alternative Legal Provider (44)

- Artificial Intelligence (AI) (57)

- Bar Regulation (13)

- Best Practices (39)

- Big Data and Data Science (14)

- Blockchain (10)

- Bloomberg Biz of Law Summit – Live (6)

- Business Intelligence (21)

- Contract Management (21)

- Cool Legal Conferences (13)

- COVID-19 (11)

- Design (5)

- Do Less Law (40)

- eDiscovery and Litigation Support (165)

- Experience Management (12)

- Extranets (11)

- General (194)

- Innovation and Change Management (188)

- Interesting Technology (105)

- Knowledge Management (229)

- Law Department Management (20)

- Law Departments / Client Service (120)

- Law Factory v. Bet the Farm (30)

- Law Firm Service Delivery (128)

- Law Firm Staffing (27)

- Law Libraries (6)

- Legal market survey featured (6)

- Legal Process Improvement (27)

- Legal Project Management (26)

- Legal Secretaries – Their Future (17)

- Legal Tech Start-Ups (18)

- Litigation Finance (5)

- Low Cost Law Firm Centers (22)

- Management and Technology (179)

- Notices re this Blog (10)

- Online Legal Services (64)

- Outsourcing (141)

- Personal Productivity (40)

- Roundup (58)

- Structure of Legal Business (2)

- Supplier News (13)

- Visual Intelligence (14)