Large law firms have faced growing pressure since 2010 to deliver more value to clients, creating pressure for efficiency and lower rates. The 2020 Law Firms in Transition Survey (June 2020) reports on large law firm trends. In my Part 1 post, I covered survey results around long term changes, innovation, and the rise of senior strategic professionals. In this Part 2, I cover alternative staffing, efficiency initiatives, and pricing.

Alternative Staffing

Overview. Firms create value for clients when they delegate work to lowest cost person (or technology) capable of doing that work effectively. Last century, that typically meant delegation to paralegals. This century, firms use a range of professionals who cost less than partner track associates.

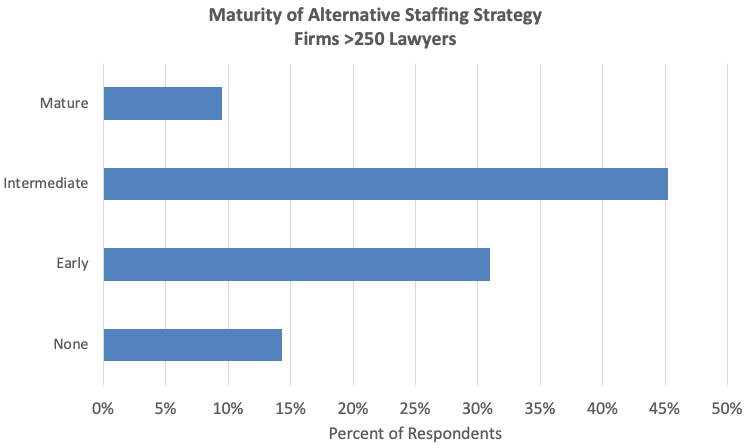

Alternative Staffing Maturity. The survey asks “how would you characterize your firm’s progress on your strategic business model as it pertains to alternative staffing strategy (labor arbitrage)?” Respondents select one of four choices on a maturity scale: None, Early, Intermediate, and Mature. I will focus on the last two:

- Mature means “Embedded firmwide, substantial competency across the firm, structure and tools in place, performance metrics available, clear alignment with firm goals”).

- Intermediate means “Significant adoption and adaptation in the firm, with policies, procedures, roles, responsibilities defined if not fully enforced, outcomes mixed, potential benefits generally understood.”

The chart shows the distribution of responses for firms with more than 250 lawyers. I was surprised to see almost 10% rating themselves Mature and 45% Intermediate. From anecdotal evidence – hearing Big Law friends talk, reading, and attending conferences – I thought the numbers would be lower.

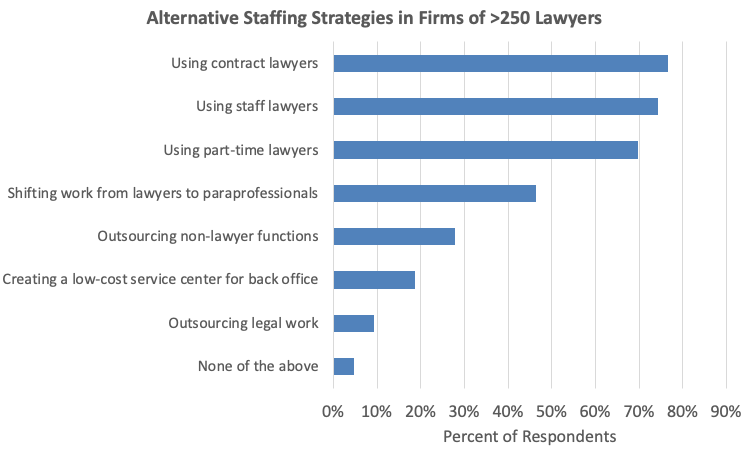

Digging Deeper into Maturity and a Survey Issue. To understand the results, I dug a bit deeper. I looked a related question, “Is your firm currently pursuing any of the following alternative staffing strategies?” The chart below shows the alternative staffing approaches firms use. Contract lawyers, staff lawyers, and part-time lawyers are all in use by more than 70% of responding firms.

I think that the disconnect between my expectations and the survey results turn on the question wording, specifically “pursing“. Firms could rightly check any of the answers if they use at alternative strategy at all. For example, using a contract or staff even on only a couple of matters could lead to check off those options honestly in response to a question about “pursuing”.

To really understand maturity of alternative staffing would, in my opinion, require data on the number of contract and staff attorneys across Big Law and how that number has changed over time.

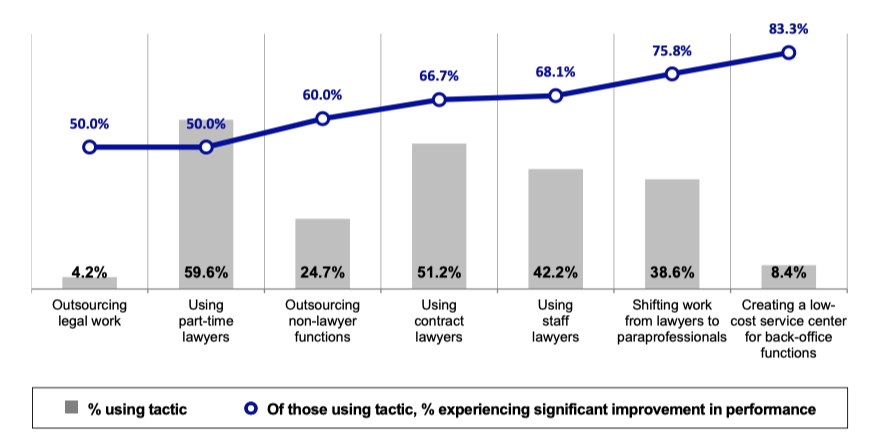

Effectiveness of Alternative Staffing Strategies. The survey also asked about the effectiveness of each strategy, asking both what strategies are in use and have they “resulted in a a significant improvement in firm performance?” Note that the chart below reflects all respondents, including firms with fewer than 250 lawyers, so the data are not directly comparable to the charts above.

It would be interesting to learn more about the perceived variations in effectiveness (the line) and why more more firms do not use these strategies given the reported improvements. All of these strategies except one are fairly easy to implement. Only building a low-cost service center is a big decision and requires substantial investment, planning, and integration work.

I wish the survey had asked about low cost centers differently. The survey choice “Creating a low-cost service center for back-office functions” means this answer is not really comparable to the other answers because it excludes legal support by referencing back-office functions. Some US firms and many of the top 30 UK firms operate low cost centers that include legal support for transactions and/or document review in disputes. A low cost center helps clients only where it supports legal work.

Efficiency Strategies

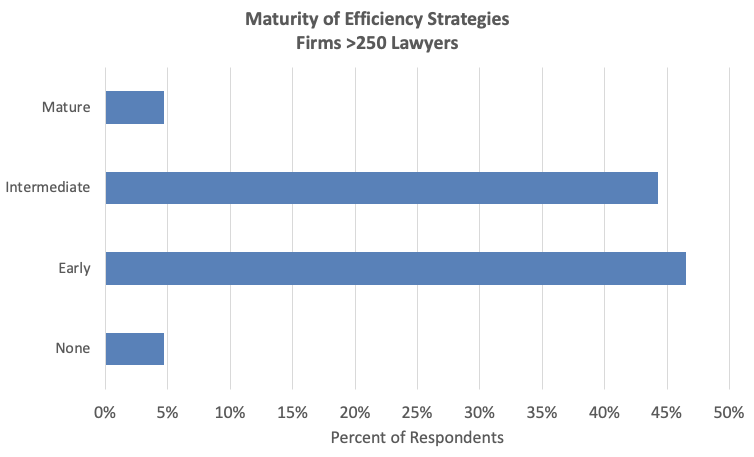

Efficiency Strategy Maturity. Firms can also create value by helping fee earners practice more efficiently. Using the same maturity scale mentioned above, Altman Weil asked “how would you characterize your firm’s progress on your strategic business model as it pertains to efficiency of legal service delivery?” The chart below shows the answer for larger law firms.

I find it sobering that about 50% of firms self-rate as early or none.

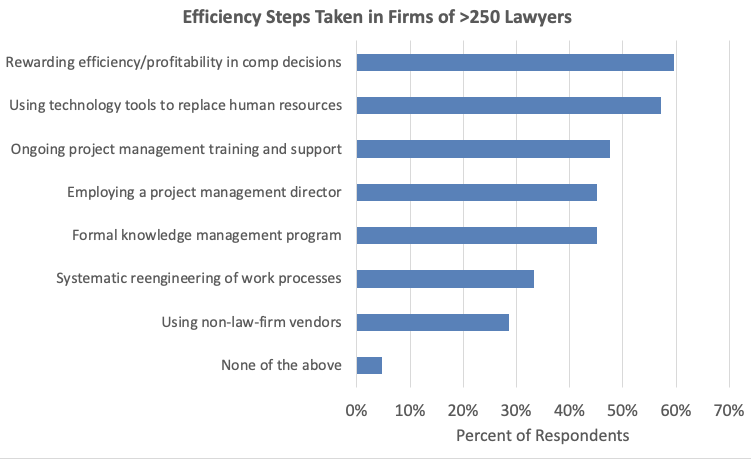

Efficiency Steps and Another Surprise. I was also surprised by large firm responses to the question “Is your firm doing any of the following to increase efficiency of legal service delivery?” as illustrated here:

The chart shows the most prevalent strategy is “Rewarding efficiency and profitability in compensation decisions.” One again, I that answer does not align with my anecdotal view of the market.

When I talk to contacts across the Am Law 200, few report partner compensation is clearly tied to profitability, which is easily measured, much less efficiency, which is much harder to measure.

If I am surprised by the remaining answers it is also that the response rate for using tech is only a bit over 50%. I was glad to see over 40% of firm report having a formal KM program.

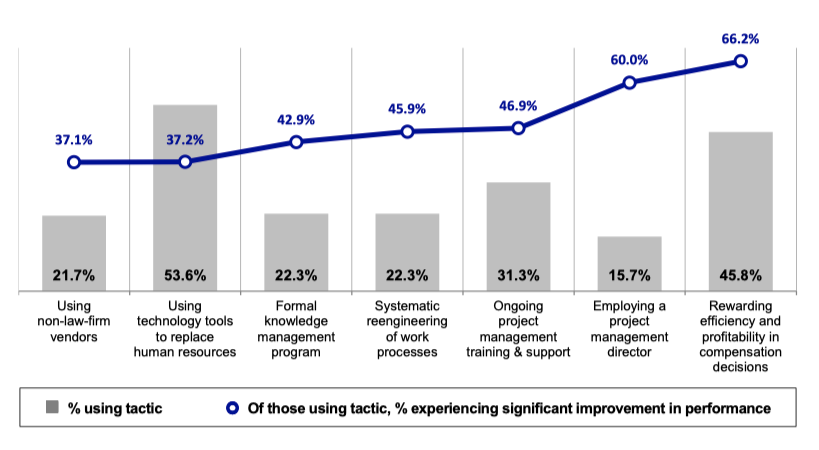

Effectiveness of Efficiency Strategies. The survey also compared the effectiveness of efficiency (“significant improvement in performance”) to the incidence of use. As with alternative staffing, this comparison includes firms of all sizes, so the chart data below are not directly comparable to the chart data above.

Looking at the gaps, I can only offer a tongue in cheek comment: Perhaps management at firms see charts like this, or learn about the effectiveness form talking to peers, and conclude “if less than half of our peers experience significant improvement using these techniques, why bother even starting?” On a serious note, I believe that all these techniques can be very effective – it takes active management and systematic change management planning.

Pricing

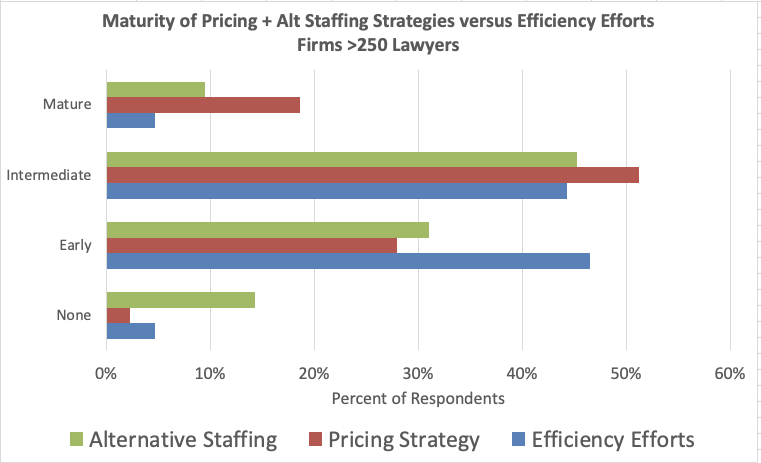

I do not report here on the various pricing measures firms take covered in multiple survey questions. Instead, I focus on one set of responses that stood out: the gap between maturity of pricing versus alternative staffing and efficiency initiatives as shown in this chart:

Note the variance in the results for Mature and Intermediate. Those gaps confirm one of my big fears: too much pricing is about moving numbers around on spreadsheets and not enough is about more efficient delivery. I don’t understand how pricing can be twice as “mature” as alt staffing and efficiency. In my view, the goal of pricing should be to deliver more value to clients while protecting or enhancing firm profitability. The main ways of doing so are in staffing (especially appropriate delegation) and efficiency. So in my mind, if firms say pricing is more mature, as they do, then that suggests value-enhancing strategies lag pricing.

Conclusions

From 2008 to 2010, the legal market shifted from a sellers’ to a buyers’ market. Clients brought much work in-house to avoid using law firms. That explains why large law firm demand has largely been flat while law department headcount has grown substantially. With that shift, firms for the first time in generations faced stiff competition for work and fee pressure.

If we look back to 2012 – after the crisis but while its impacts still were palpable if not raw – what would we have guessed that a 2020 survey would show? I would have expected to see more progress than the data here show. I suppose there is a glass half full / half empty take here: about half the firms have progressed and the other half have easy opportunities to do so. Looking forward, Bayesian probability suggests that additional change will come slowly.

Large Law Firm Trends in 2020 – Part 2 (Efficiency + Value)

Archives

Blog Categories

- Alternative Legal Provider (44)

- Artificial Intelligence (AI) (57)

- Bar Regulation (13)

- Best Practices (39)

- Big Data and Data Science (14)

- Blockchain (10)

- Bloomberg Biz of Law Summit – Live (6)

- Business Intelligence (21)

- Contract Management (21)

- Cool Legal Conferences (13)

- COVID-19 (11)

- Design (5)

- Do Less Law (40)

- eDiscovery and Litigation Support (165)

- Experience Management (12)

- Extranets (11)

- General (194)

- Innovation and Change Management (188)

- Interesting Technology (105)

- Knowledge Management (229)

- Law Department Management (20)

- Law Departments / Client Service (120)

- Law Factory v. Bet the Farm (30)

- Law Firm Service Delivery (128)

- Law Firm Staffing (27)

- Law Libraries (6)

- Legal market survey featured (6)

- Legal Process Improvement (27)

- Legal Project Management (26)

- Legal Secretaries – Their Future (17)

- Legal Tech Start-Ups (18)

- Litigation Finance (5)

- Low Cost Law Firm Centers (22)

- Management and Technology (179)

- Notices re this Blog (10)

- Online Legal Services (64)

- Outsourcing (141)

- Personal Productivity (40)

- Roundup (58)

- Structure of Legal Business (2)

- Supplier News (13)

- Visual Intelligence (14)