I report here on a recent, privately conducted knowledge management survey of large law firms. Mary Abraham, Oz Benamram and I conduct this survey in preparation for a meeting of KM professionals in February. Learning about current KM priorities and interests inform our agenda. We share detailed survey results with respondents and I blog a subset of the results.

1 About this Survey

1.1 The Questions Asked and Chart Labels

At the end of each year, we ask three primary questions; the quoted text in parentheses corresponds to chart labels that appear later in this report.

- What are your top priorities for 2017? (“2017 Priority”)

- What did you focus on in 2016? (“2016 Focus”)

- What would you like to discuss with the group in 2017? (“2017 Discuss”)

1.2 Survey Demographics and Caveats about Interpreting It

I share here survey details so that readers understand the demographics and potential limitations in interpreting results.

- Firm Size and Location: Most respondents work at US, Canadian, and UK firms with 500 or more lawyers.

- Survey Not Representative of Market. We survey large law firms where we have identified senior KM professionals. The survey therefore selects for firms with a KM commitment. We believe the survey results reflect the direction of KM for such firms but it says nothing about firms with minimal KM investments.

- Respondents Provide Free-Form Text Answers and Tag Answers: Respondents answer each question with free-form text and then tag their answers into one or more of 16 defined topics (tags). These tags inform most of the survey interpretation. The list of tag names follows; for purposes of charts, I abbreviate them:

- AI or data science

- AFA / Budget / LPM

- Client-Facing KM (except expert systems)

- Collaboration / Internal Social Media

- Content management / DMS

- eDiscovery / litigation support

- Expert systems

- Experience location

- Forms, precedents & document assembly

- Matter management

- Portal redesign or upgrade

- Process improvement

- Security / access management / info. gov.

- Search (install, upgrade, or improve)

- Selling / marketing KM internally

- Other

- Question Changes in 2017. This survey added one new question and tag versus the prior three years: AI or data science. And it consolidated two prior year tags, social media and collaboration, into just the latter.

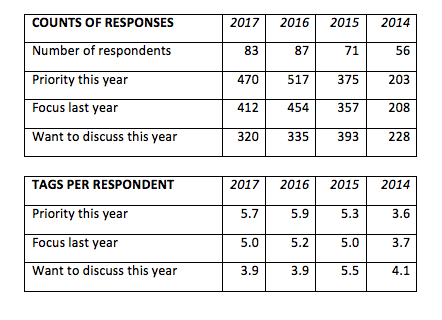

- Year-to-Year Comparisons and Multiple Tag Selections Per Question Allowed: The first table below shows the number of respondents by year and number of tags per question. Because of changes in both the number and mix of respondents, year-to-year results may not be directly comparable. The second table shows tags chosen per respondent. These data provide some guidance on yearly comparability. From 2014 through 2016, we had no changes in tags. The tag changes this year may call into question inter-year comparisons.

2 Survey Results and Interpretation

2.1 Summary of 2017 Responses and Gaps Between Priority and Focus

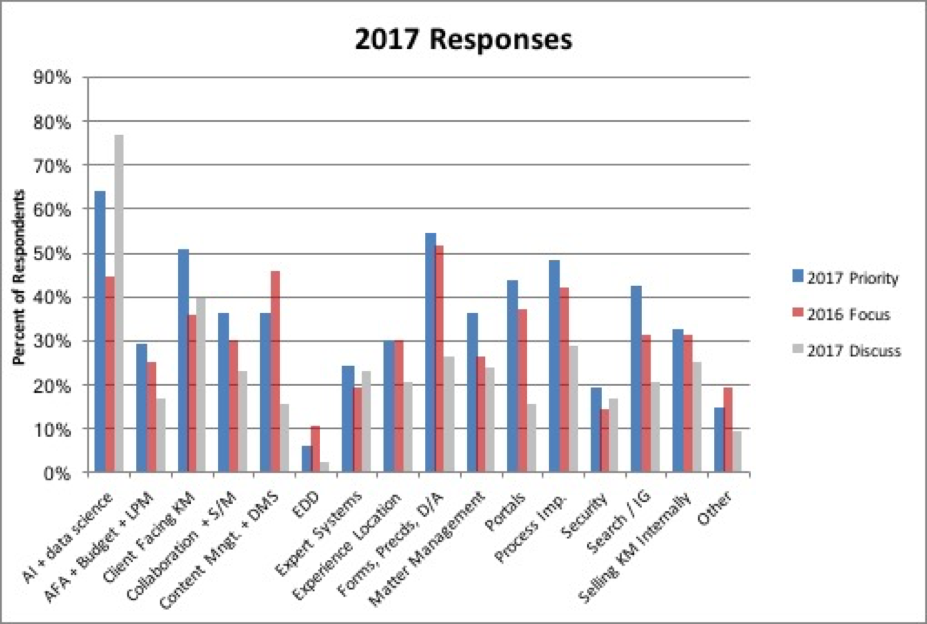

This chart shows responses to the 2017 survey, which we administered in late 2016:

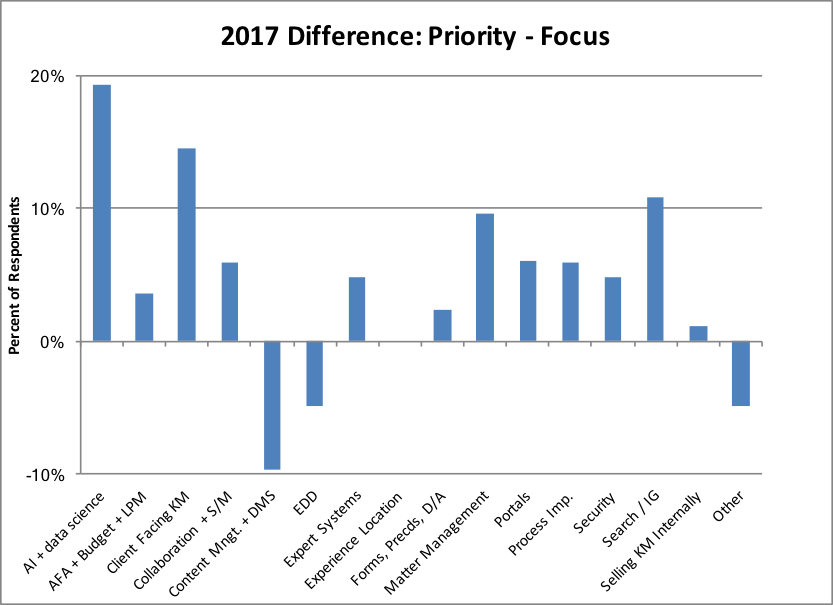

2.2 Gaps Between Priority and Focus – Shifts in Attention from 2016 to 2017

We find it instructive to examine the gap between Priority and Focus. Recall that Priority refers to 2017 priority intent and that Focus refers to what respondents worked on in 2016. The gap reflects shifting attention from last year to this year.

The difference between the percentages for Priority and Focus remain, as they did for 2016, relatively small to some changes we saw in prior years.

The biggest gaps – in artificial intelligence (AI) and client facing KM – are not surprising given recent news reports. AI is clearly the hot topic for respondents. And I know from reading and private conversations that AI is also a hot topic among large firm COOs and managing partners. I have never seen a technology grab so much senior attention so quickly.

Interest in client-facing KM has increased. The survey does not get at the root cause but I suspect it reflects the general drive of large firms to deliver more client value, improve service delivery, and increase relationship stickiness.

Search and information governance also shows a gap. That reflects two recent and unrelated market developments. First, in the age of cyber-breaches, information governance has assumed new importance. And second, the acquisition of Recommind by OpenText caused many Recommind law firm customers to re-think their search plans. Some started in 2016 and these data seem to suggest more will do so in 2017. And in the many conversations I have with large law firms, I also see growing interest in search from firms that never deployed robust enterprise search.

Content management and document management systems (DMS) will receive less attention. I find this surprising given that many firms have changed or are considering changing brands of DMS. Perhaps the DMS migration plans were set in motion by KM professionals in 2016 and now execution is moving to IT departments.

Matter Management has also shifted but this is a bit of grab bag tag so I hesitate to interpret it. The rest of the shifts are relatively small and, therefore, do not warrant discussion.

2.3 Shifting Priorities Across Years

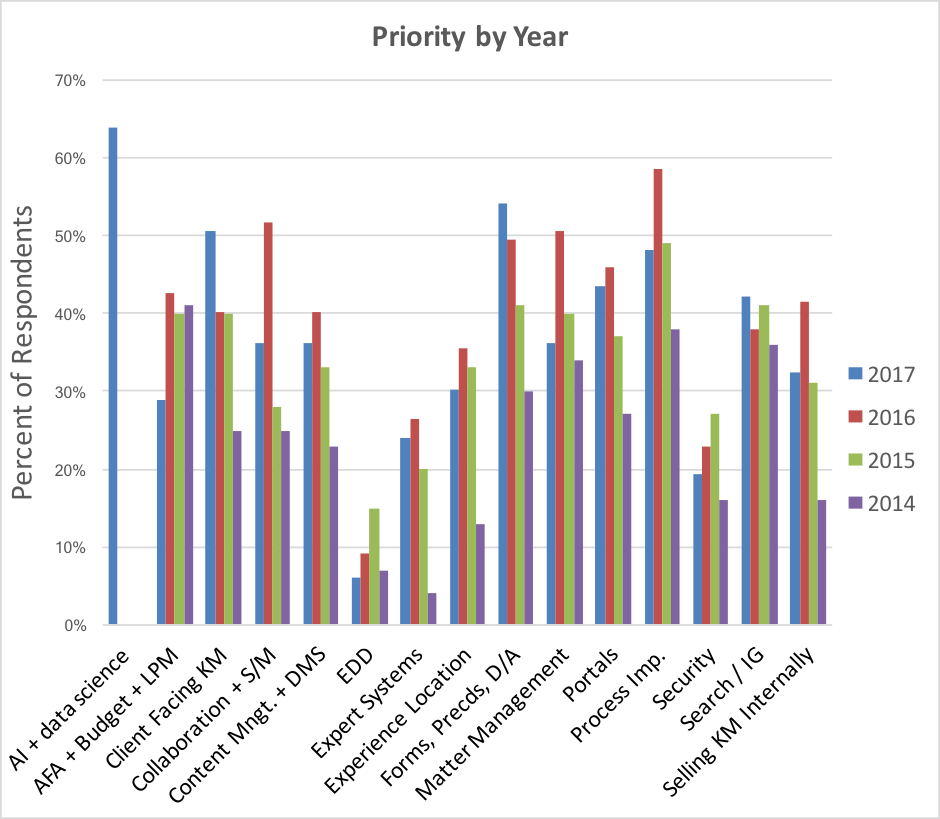

The chart below shows how priorities have shifted over time. In the text below the chart, I discuss those tags with greater than a 10-percentage point shift.

AI is hot. Though this is the first year we have an AI tag, based on comments last year, it almost certainly would not have been nearly so high in 2016. And it was barely on the radar in 2015.

Alternative fee arrangements (AFA) are now of less interest to KM professionals. This change likely reflects the practice of firms to move AFA work from KM to pricing professionals.

Client-facing KM is on the rise, likely as noted above because of market dynamics that drive law firms to deliver better value to clients.

Collaboration has seesawed over time. As I noted last year, firms can now license a new generation of collaboration software, both general market and legal-specific. With press attention on the former, e.g., Slack and the recently released Microsoft Teams, I had expected collaboration interest to grow, not shrink. I cannot tell from comments if this reflects disappointment or competing demands for time and attention.

I do not have good explanation for the drops in Matter Management and Process Improvement. The former is, as noted above, something of a catchall tag so I draw no conclusions. The latter surprises me because in my anecdotal experience, I see growing interest in process improvement. Improving legal processes, while very valuable, also requires significant effort. One hypothesis is that fewer firms pursue it but those that do, do so more intensively.

2.4 2016 Priorities Compared to Discussion Interests

Each year we also compare respondents’ priorities (“Do”) with what they would like to discuss (“Talk”). Charts below show two views of this comparison.

The number of tags across answers differs substantially: 470 Do but only 320 for Talk. It is therefore an arithmetic certainty that Do will outweigh talk absent normalization. To present what I believe is a more realistic picture, I applied the percentage of 320/470, which is 68%, to Do. On this normalized basis, the findings make more sense:

The variance between Do and Talk is relatively small for most tags. AI stands alone since it is new this year and hot – everyone wants to discuss but not everyone will have the budget or time to do it.

The only two other tags with a 10-point greater difference are portals and forms. Forms are a mature topic so I am not surprised interest in talking about it falls below the priority level. The gap for portals I find more surprising. Portals are also arguably mature. But many firms are now redesigning and rethinking them, driven by the need to upgrade old designs and the desire to take advantage of a new generation of User Interface thinking and more flexible tools.

3 Conclusions

I draw two main conclusions from the survey. First, KM remains robust. Interest in this meeting and survey remains robust. Each year we identify more firms to add to the list. Second, KM has certain core activities but also takes on an ever-changing set of initiatives. KM professionals will likely always spend some time on forms + precedents and on maintaining or upgrading search. But they also work on a shifting range of activities, from pricing, AI and process improvement, to new methods of collaboration.

Archives

Blog Categories

- Alternative Legal Provider (44)

- Artificial Intelligence (AI) (57)

- Bar Regulation (13)

- Best Practices (39)

- Big Data and Data Science (14)

- Blockchain (10)

- Bloomberg Biz of Law Summit – Live (6)

- Business Intelligence (21)

- Contract Management (21)

- Cool Legal Conferences (13)

- COVID-19 (11)

- Design (5)

- Do Less Law (40)

- eDiscovery and Litigation Support (165)

- Experience Management (12)

- Extranets (11)

- General (194)

- Innovation and Change Management (188)

- Interesting Technology (105)

- Knowledge Management (229)

- Law Department Management (20)

- Law Departments / Client Service (120)

- Law Factory v. Bet the Farm (30)

- Law Firm Service Delivery (128)

- Law Firm Staffing (27)

- Law Libraries (6)

- Legal market survey featured (6)

- Legal Process Improvement (27)

- Legal Project Management (26)

- Legal Secretaries – Their Future (17)

- Legal Tech Start-Ups (18)

- Litigation Finance (5)

- Low Cost Law Firm Centers (22)

- Management and Technology (179)

- Notices re this Blog (10)

- Online Legal Services (64)

- Outsourcing (141)

- Personal Productivity (40)

- Roundup (58)

- Structure of Legal Business (2)

- Supplier News (13)

- Visual Intelligence (14)