The ILTA 2014 Law Firm Tech Survey was just released. The International Legal Technology Association each year conducts a comprehensive survey of law firm technology. At 301 pages, the report is packed with information.

I summarize here findings on practice support and the business of law that I find interesting; I also offer some comments. This survey is a Herculean effort and we should all applaud ILTA and the many volunteers and participants who make it possible.

Social Networking and Collaboration Tools (p. 61). The results here disappoint but do not surprise. Much of Big Law had great hope for consumer-style social media re-tooled for the enterprise (and run behind the firewall). Three years ago, firms experimented with secure social network tools. Even firms that had good initial uptake (and they were few) could not sustain the momentum. The survey results show this painfully: more than 75% of firms do not even have a tool. About 15% report using Microsoft Lync. I view it more as a communication than collaboration tool. My discussion with firms that have Lync suggest rather limited use by lawyers. A separate set of survey results (p. 246) shows that under 25% of firms with more than 350 lawyers use instant messaging or presence detection.

Legal Project Management and Budgeting (p. NA). The survey did not ask about legal project management, pricing, or budgeting software. I may suffer from reporting bias but all three seem to be hot topics (albeit, perhaps more smoke than fire). In spite of much talk, it is possible that the limited efforts to date have not yet risen to a level where IT needs to be particularly engaged. As clients demand value and as more firms respond, demand for LPM, budgeting, and pricing software surely will grow. So I hope the survey will cover this area in the future.

Contact Management and Marketing (p. 76). Corporate CMOs looking at these results, if they understood all the software listed, would undoubtedly chuckle. Companies that take lead generation and opportunity development seriously – by which I mean systematic tracking – use products such as Salesforce.com. In over 400 firms, only 3 report using Salesforce. I don’t recognize all the packages listed but I’m pretty sure few replicate even a tenth of Salesforce or comparable tracking functionality. Law firms that move beyond contact management to leading tracking and quantitatively assessing marketing programs likely can gain a competitive edge (or at least save money).

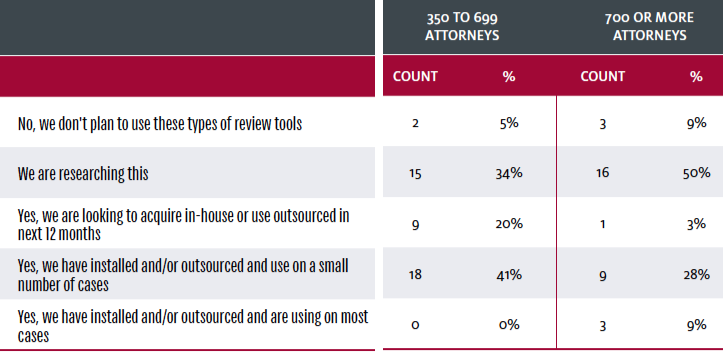

Predictive Coding / Computer Assisted Review (p. 158). It’s hard to pick up a legal tech maganze from the last 5 years and not see an article about technology assisted document review in discovery (or antitrust or investigations). So I was surprised to see what I consider fairly low percents of larger law firms using what I thought was a well-established (if not universally accepted) technology and process:

Document Assembly (p. 59). Less than half of responding firms report using any document assembly. Of course, even for those that do, the amount of use is likely low. Document assembly is one of the oldest legal technologies, dating at least from the 1980s. For a seemingly niche product, providers abound. Contract Express and HotDocs have the biggest share among larger law firms.

Document Management Systems (p. 69). Autonomy Worksite continues to hold the dominant share among larger firms. My own travels in Big Law suggest that NetDocs is gaining share so we may see a bigger shift to NetDocs in the 2015 results. The surprise here is that over 90% of firms still default documents to be available to all users. In 2014, I was part of many a discussion with large law firms about the “least privileged security”model, meaning documents are available only to those on the team. Quite a few financial institutions demand this, or at least start off demanding it. Keep an eye on these data.

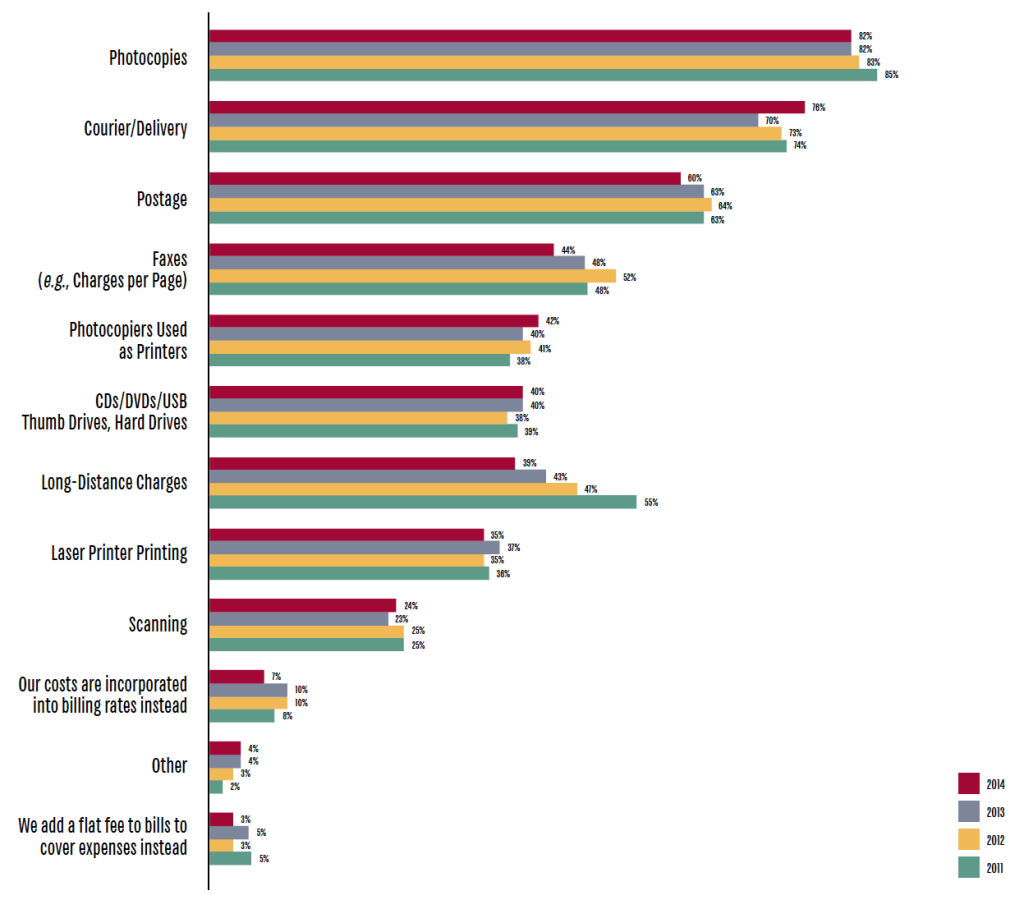

Chargebacks to Clients (p. 120). OK, this is not really about tech but this chart jumped out at me. Many firms continue charging for items that many clients likely consider overhead. Of course, we do not know what the realization rate is on these chargebacks. I have to imagine these data do not make clients feel good about their outside counsel. (Oh, and really, faxes? – not so much charging but that anyone still uses them.)

End Note on survey demographics:

Page 7 of the survey indicates that over 450 firms responded the the survey, categorized by:

– # of LAWYERS # FIRMS PERCENT

– 700+ Lawyers 34 8%

– 350 – 699 47 10

– 150 – 349 84 19

– 50 – 149 141 31

– < 50 148 33

Archives

Blog Categories

- Alternative Legal Provider (44)

- Artificial Intelligence (AI) (57)

- Bar Regulation (13)

- Best Practices (39)

- Big Data and Data Science (14)

- Blockchain (10)

- Bloomberg Biz of Law Summit – Live (6)

- Business Intelligence (21)

- Contract Management (21)

- Cool Legal Conferences (13)

- COVID-19 (11)

- Design (5)

- Do Less Law (40)

- eDiscovery and Litigation Support (165)

- Experience Management (12)

- Extranets (11)

- General (194)

- Innovation and Change Management (188)

- Interesting Technology (105)

- Knowledge Management (229)

- Law Department Management (20)

- Law Departments / Client Service (120)

- Law Factory v. Bet the Farm (30)

- Law Firm Service Delivery (128)

- Law Firm Staffing (27)

- Law Libraries (6)

- Legal market survey featured (6)

- Legal Process Improvement (27)

- Legal Project Management (26)

- Legal Secretaries – Their Future (17)

- Legal Tech Start-Ups (18)

- Litigation Finance (5)

- Low Cost Law Firm Centers (22)

- Management and Technology (179)

- Notices re this Blog (10)

- Online Legal Services (64)

- Outsourcing (141)

- Personal Productivity (40)

- Roundup (58)

- Structure of Legal Business (2)

- Supplier News (13)

- Visual Intelligence (14)