This post, the 2020 KM + Innovation Survey Results, reports on the survey to support the 2020 Strategic Knowledge + Innovation Legal Leaders’ Summit, which took place in early February 2020. The Summit is a meeting of about 65 senior knowledge management professionals from large US, UK, and Canadian law firms.

Lucy Dillon, Mary Abraham, Oz Benamram, and I organize the meeting each year. To prepare for it, we survey invitees toward the end of each year to learn about current knowledge management and innovation priorities and plans. We share detailed survey results with respondents and I publicly share a subset of the results here. (See the 2019 Survey results here.) An Appendix at the end of this post has demographic information and qualifiers about the survey.

We ask three primary questions; the quoted text in parentheses corresponds to chart labels that appear later this this report:

- What are your top priorities for 2019? (“2019 Priority”)

- What did you focus on in 2018? (“2018 Focus”)

- What would you like to discuss with the group in 2019? (“2019 Discuss”)

Lucy, Mary, and Oz reviewed and contributed to the report we circulated to participants and attendees. I have unilaterally edited that version for this public presentation.

Summary of 2020 Responses

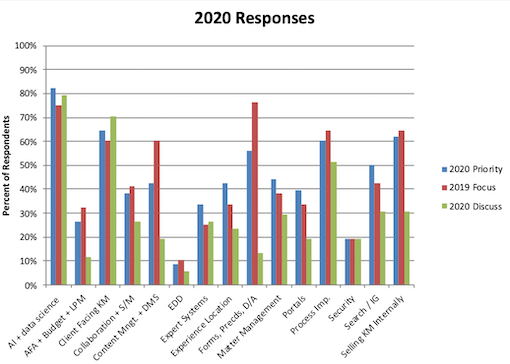

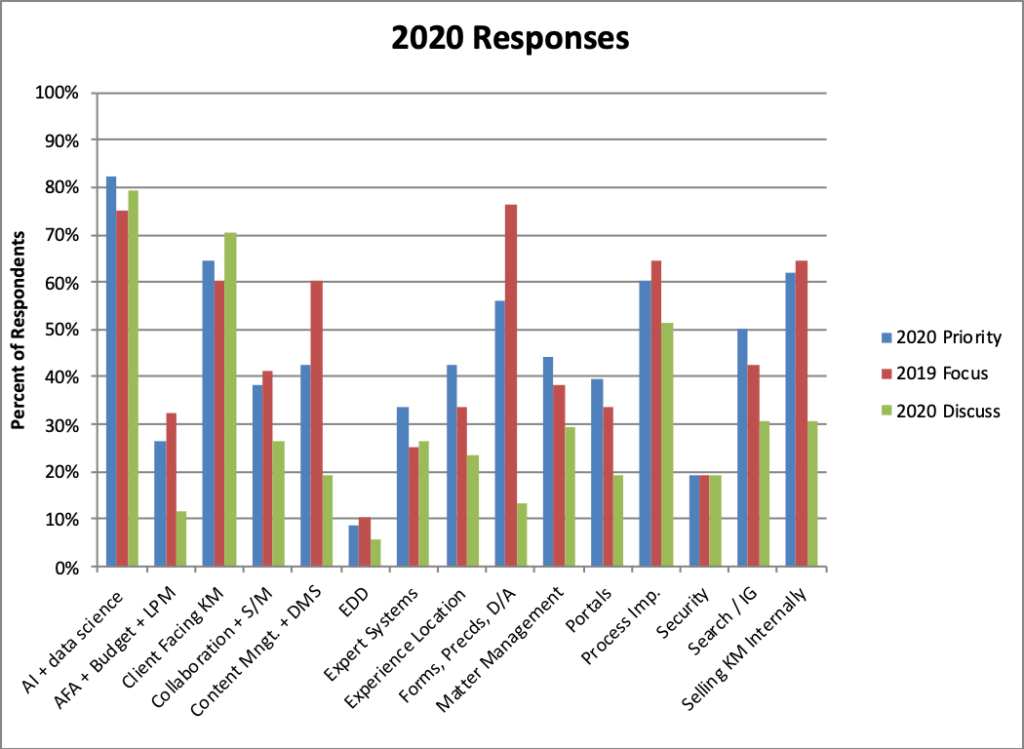

The chart below shows the 2020 survey responses. We publish these results every year and have, in the past, commented on changes in year-over-year responses. For 2020, we adjusted both the meeting format and invitee list, resulting fewer respondents than in recent years. The decrease makes year-to-year comparisons statistically risky and of limited value. Instead of year-over-year comparisons, our analysis this year focuses on just the 2020 results.

“New” and “Traditional” KM: A Subjective Assessment of 2019 Focus

Going Beyond Our Answer Tags. Answer tags are, by design, not granular. For a more nuanced, albeit subjective view, we reviewed the text answers to the 2019 focus question to classify each with a substantive KM or innovation project name.

Focus Naturally Broke into “New” and “Traditional” Activities. We saw a natural bifurcation: what we call “New KM and Innovation,” activities new in about the last five years, and “Traditional KM,” activities older than five years. In the list below, we alphabetize the activities because we intentionally do not attribute meaning to the order.

Most Activities Easy to Classify, Two Not. We found it easy to classify most projects as New or Traditional though two required some discussion. Experience location is a traditional KM discipline but we labeled experience management systems as New because over the last five years, robust, enterprise software purpose-built for this function have come to market and many firms have deployed a product. Similarly, litigation analytics as a concept is Traditional but the last five years has seen the rise of new approaches from both start-ups and established providers. We view that as a big change from the past so consider it New.

- NEW KM and INNOVATION ACTIVITIES

- Artificial intelligence

- Chatbot building

- Contract analytics

- Data analytics and visualization

- Deal platforms and management

- Experience management systems

- Innovation initiatives

- Launching start-ups within law firms

- Litigation analytics

- Push systems (deliver KM when / as needed)

- Robotic process automation

- Smart contracts

- TRADITIONAL KM ACTIVITIES

- Client-facing KM

- Closing binder streamlining

- Collaboration platforms

- Deal databases and provision-trend analysis

- Document automation

- Document management systems

- Email management

- Enterprise search

- Expert systems

- Legal project management (LPM)

- Matter management tools

- Portals

- Precedents and playbooks

- Process mapping

- Professional support lawyers

- Workflow

Conclusions from Classifying: KM and Innovation Remain Robust. A few years ago, some KM professionals worried that “KM is dead.” While many KM professionals continue working on long-standing elements of KM, others work on relatively new elements, some cutting edge. Fittingly, some of these professionals now have “innovation” as well as “knowledge” as a part of their title. We think that the two lists show that KM remains vibrant and that the scope of KM over the last two decades has expanded significantly. Indeed, we believe this evolution shows the power of KM to adapt and seize opportunities to move the delivery of legal service forward.

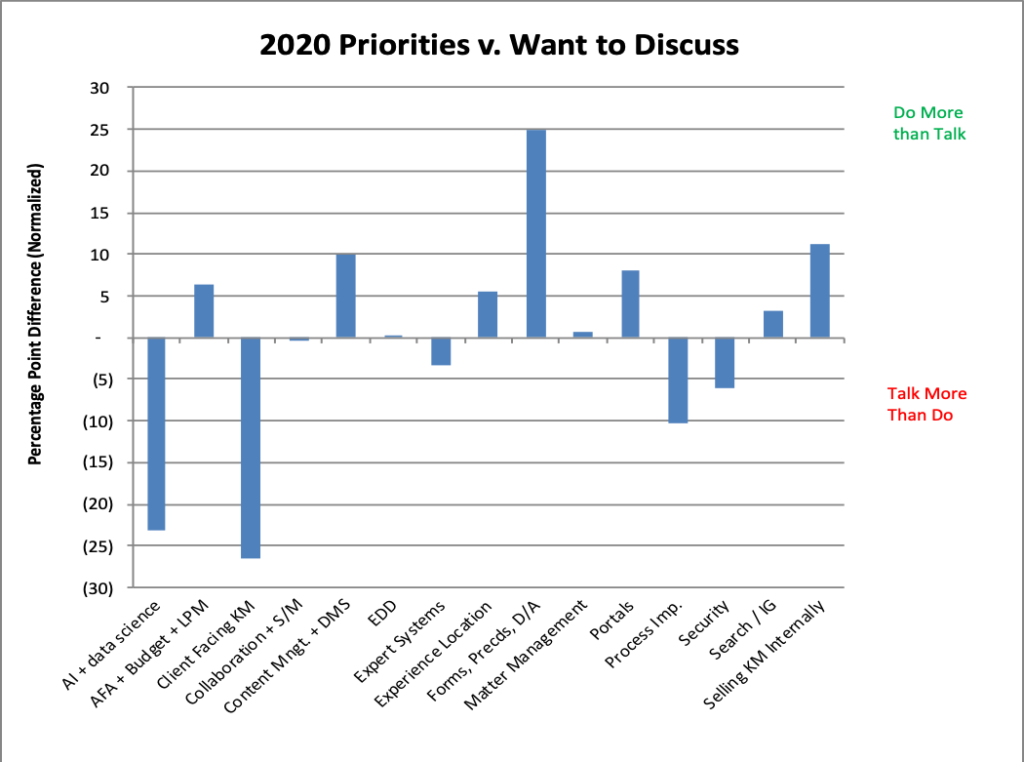

2020 Priorities Compared to 2020 Discussion Interests

Comparison of Priorities and Discussion Interests. Each year we compare respondents’ priorities (“Do”) with what they would like to discuss (“Talk”). See the chart below for this comparison. These data are comparable because all answers come from the same respondents in the same year. Because the number of Do versus Talk tags differs significantly, however, we have normalized the percentages to make this comparison. We discuss below the biggest gap in each direction.

Talk>Do: Client-Facing KM. The biggest “talk more than do” gap is client-facing KM. We think that reflects two related large law firm trends. First, all organizations face pressure to digitally transform. Digital transformation is a widely used and frequently underspecified term. It typically includes web-based or mobile-enabled self-service options, for example, buying airline tickets on the web or summoning a shared car. Whatever digital transformation means for law firms, we think client-facing KM contributes to it. Second, large law firms continue to face growing competition to keep existing business and win new work. That competitive pressure causes more firms to focus greater attention on creating or enhancing client-facing systems, which can differentiate the firm and add value for clients.

Do>Talk: Forms and Precedents. Forms and precedents, in contrast, show a big gap in the other direction, i.e., “do more than talk.” This is a perennial pattern: forms are a mature discipline, so we are not surprised in the gap. The doing here is well-understood and therefore does not need much discussion.

AI Comment. A comment on AI is also in order. Last year, AI and data science had the biggest below-the-line gap. We think its drop to second place reflects that legal AI is maturing, or at least becoming mainstream and widely understood. Yet it continues to exert strong “sex appeal” and the gap remains large. KM and innovation leaders want to continue discussing it, or at least hear from others to help assess where their firm stands.

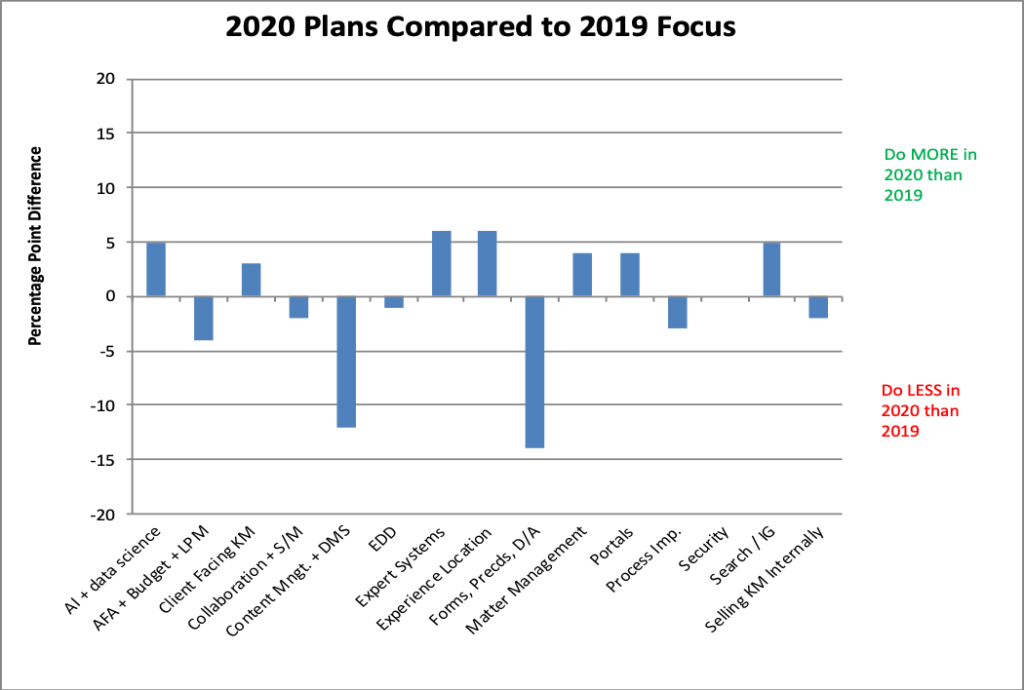

How Priorities Will Shift: 2020 Plans Compared to 2019 Focus

Shifting Priorities. We also compared 2020 plans and 2019 actual focus. These data are comparable and show intended shifts in priority. (The difference in number of tags per answer was immaterial so we did not normalize.)

Doing Less Forms + Precedents Repeats the Pattern. We start with our view about the two big below-the-line gaps (do less in 2020 than in 2019). As we observed in prior years, many KM professionals find they must work on forms, precedents, and document assembly, even though they may not gravitate toward doing so. “Hope springs eternal,” so fewer plan to focus on this. We may learn next year if this turns out to be true.

Doing Less DMS Likely Reflects Upgrade Cycle. We believe the “do less” for content management and DMS reflects the cyclical nature of document management system upgrades. Both NetDocs and iManage released major upgrades in recent years. Some firms have switched brands and others upgraded. The drop likely reflects that, for participating firms, those changes have wrapped up for now.

Comments on the Relatively Small “Do More” Tags. Turning to above the line differences, expert systems and experience location tie for the biggest shift to doing more in 2020 than in 2019. A five-point shift is not big – it could easily be natural variation. Or it might reflect that both these product categories have gained market traction. Until recently, there was only one viable legal market expert system product; now there are several. We think the growth in number of providers serves as a lagging indicator for the growing interest and activity of large firms in developing these systems. (If you know of any leading indicators, we would love to hear from you.) Separately, as noted above, purpose-built experience management remains one of the newer categories of large firm enterprise software. We are thus unsurprised to see increased activity around it. Furthermore, the large firms, even the top ones, face growing competition. Enterprise experience management software has virtually become a required tool to improve win rates on pitching for new work.

Conclusions

Despite changes in our survey, the conclusions we draw this year remain similar to those from recent years. First, KM remains robust and interest in it continues to grow.

Second, as we noted above, KM continues to have a core of what we now call “traditional KM” but also tackles an ever-wider set of initiatives, especially innovation. KM professionals will likely always need to spend some time on core activities such as forms and precedents or upgrading the DMS or search. But they also work on a shifting range of activities, from pricing and process improvement starting a decade ago, to the more recent addition, for example, of AI, data analytics, and innovation.

This survey suggests that senior law firm management must hire a growing cadre of experienced professionals who understand law practice, law firm business management, legal clients, and, increasingly data analytics. That combination of skill and experience will drive the evolution of law firm service delivery – and competition for new business.

Appendix: About this Survey

The Questions Asked and Chart Labels

At the end of each year, we ask three primary questions, listed below. The quoted parenthetical text corresponds to chart labels that appear in the charts above and text above.

- What are your top priorities for 2019? (“2019 Priority”)

- What did you focus on in 2018? (“2018 Focus”)

- What would you like to discuss with the group in 2019? (“2019 Discuss”)

Survey Demographics and Caveats About Interpreting It

Here are demographic and other details about the survey that highlight potential limitations:

- Firm Size and Location: Most respondents work at US, Canadian, and UK firms with 500 or more lawyers.

- Survey Not Representative of Market. We survey large law firms where we have identified one or more senior KM professionals. The survey therefore selects for firms with a KM commitment.

- Respondents Provide Free-Form Text Answers and Tag Answers: Respondents answer each question with free-form text and tag their answers with one or more of 16 defined topics (tags). These tags, listed below, inform the survey interpretation

- AI or data science

- AFA / Budget / LPM

- Client-Facing KM (except expert systems)

- Collaboration / Internal Social Media

- Content management / DMS

- eDiscovery / litigation support

- Expert systems

- Experience location

- Forms, precedents & document assembly

- Matter management

- Portal redesign or upgrade

- Process improvement

- Security / access management / info. gov

- Search (install, upgrade, or improve)

- Selling / marketing KM internally

- Question + Tag Variation Over Time. The 2017-2020 surveys asked the same questions using the same tags. Questions in the 2015 and 2016 were almost the same.

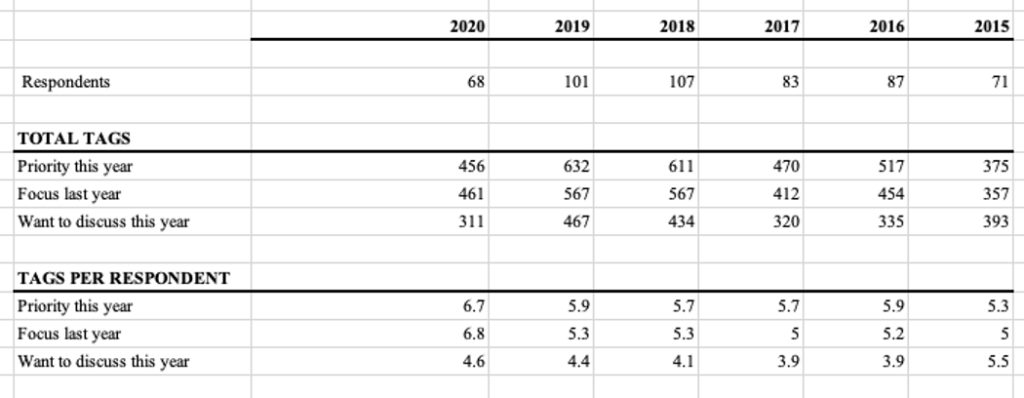

- Caution on Year-to-Year Comparisons. The table below shows number of respondents and tags per answer for the last six years. When interpreting surveys over time, understanding changes in respondents and response options is key. From 2016 to 2019, the demographics and number of respondents remained fairly consistent. For 2020, however, we adjusted the invitee list to yield a smaller group consisting of more senior KM and/or innovation professionals working in large firms. Consequently, results for 2020 are not directly comparable to prior years’ results.

Archives

Blog Categories

- Alternative Legal Provider (44)

- Artificial Intelligence (AI) (57)

- Bar Regulation (13)

- Best Practices (39)

- Big Data and Data Science (14)

- Blockchain (10)

- Bloomberg Biz of Law Summit – Live (6)

- Business Intelligence (21)

- Contract Management (21)

- Cool Legal Conferences (13)

- COVID-19 (11)

- Design (5)

- Do Less Law (40)

- eDiscovery and Litigation Support (165)

- Experience Management (12)

- Extranets (11)

- General (194)

- Innovation and Change Management (188)

- Interesting Technology (105)

- Knowledge Management (229)

- Law Department Management (20)

- Law Departments / Client Service (120)

- Law Factory v. Bet the Farm (30)

- Law Firm Service Delivery (128)

- Law Firm Staffing (27)

- Law Libraries (6)

- Legal market survey featured (6)

- Legal Process Improvement (27)

- Legal Project Management (26)

- Legal Secretaries – Their Future (17)

- Legal Tech Start-Ups (18)

- Litigation Finance (5)

- Low Cost Law Firm Centers (22)

- Management and Technology (179)

- Notices re this Blog (10)

- Online Legal Services (64)

- Outsourcing (141)

- Personal Productivity (40)

- Roundup (58)

- Structure of Legal Business (2)

- Supplier News (13)

- Visual Intelligence (14)