Last week Altman Weil released its 2020 Law Firms in Transition Survey, which reports on large law firm trends as of 2020. I provide comment here on several, including long term changes, innovation, and how many firms have senior strategic professionals. Part 2 of this post will cover additional trends, mainly around creating value for clients. [I also Tweeted about findings, here. I last blogged about the Law Firms in Transition survey in 2017, here]

Views of GFC-Induced Trends are Stable

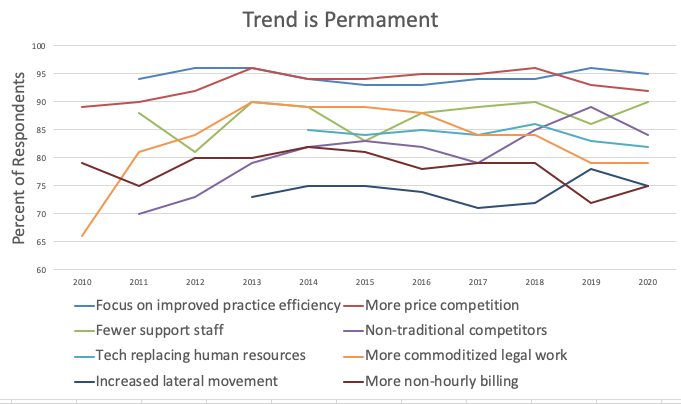

Question: “Which of the following legal market trends do you think are temporary and which will be permanent? “)

The 2008-10 Great Financial Crisis changed the legal market. It suddenly became more competitive, value-driven, and cost conscious. Examples include the drive to improve efficiency, deploy legal tech, compete on price, and offer alternative fees. The chart above shows that responding firms perceive those trends as both permanent and stable since 2012.

Note, however, that agreeing a trend is permanent tells us nothing about whether it a firm has taken action or will do so. For that, we have to rely on other responses to other questions…

A Continuing Gap between Needed and Actual Change

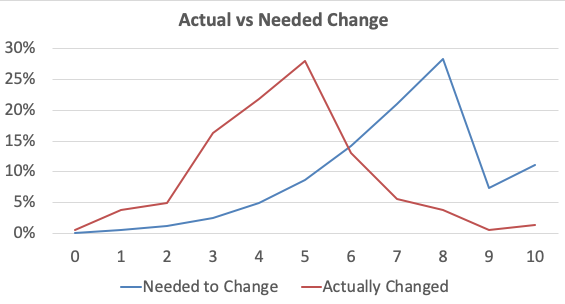

Questions: “In your opinion, over the last ten years, how much have law firms needed to change in order to stay competitive?” and “In your opinion, over the last ten years, how much have law firms actually changed compared to the amount of change that was needed?”

The chart above shows, on a scale where 1 is no change and 10 is a big change, the gap between needed and actual change. The median scores are 7 and 5 for need and actual respectively (not shown explicitly in chart).

This gap is not new. Both the 2020 survey and ones in prior years find that management understands the need for change but that ensuring action remains a challenge. The two most common reasons for the gap, explained in a separate question, remain the same over time: “Partners resist most change efforts” at 70% and “Clients aren’t asking for it” at 65%.

Innovation Appears Widespread but Underfunded

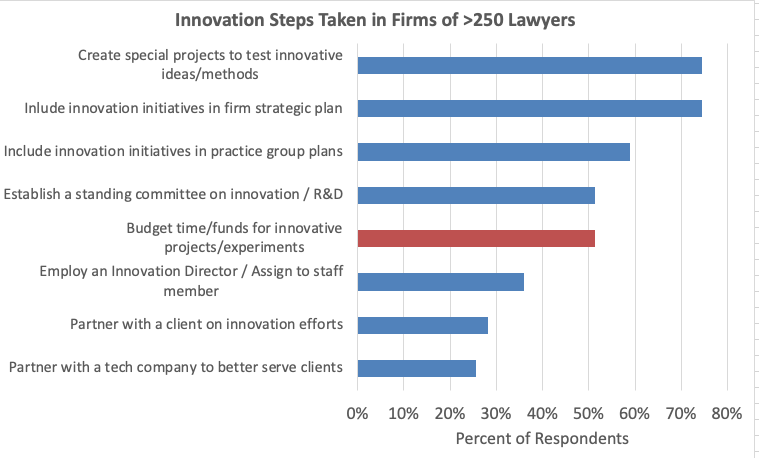

Question: “Does your firm employ one or more individuals full-time in each of the following business roles and levels?”

Ten or 20 years ago, few in the legal market discussed innovation. I do not recall a survey asking about innovation until about five years ago. The findings this year are a glass half-full / glass half-empty story. Almost 75% of responding firms with more than 250 lawyers report innovation initiatives and planning for innovation in the firm’s strategic plan. Yet only 50% specifically fund it.

The old adage “follow the money” applies here in my view; initiatives and planning without funding likely have limited impact. See also the next chart, showing that under 20% of 250+ lawyer firms have a an innovation officer or director. Assuming respondents answered questions consistently, this means that of the 35% of firms that “employ an Innovation Director / Assign to staff member”, more than 15 of the 35 percentage points are staff members. And I’m guessing that without a Director or Chief, those staff who focus on innovation likely have responsibilities besides innovation.

Senior Positions for Legal Delivery + Strategy Have Low Penetration

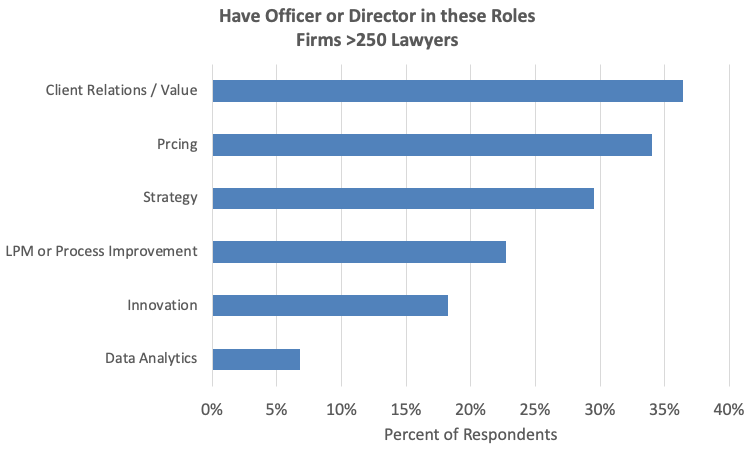

Question: “Does your firm employ one or more individuals full-time in each of the following business roles and levels?”

The last decade saw the rise of many new positions in law firms, ones focused on what I loosely call legal delivery and strategy. The numbers seemed large to me based on what I heard at conferences, what I read in legal publication, and what I saw in my work. Perhaps without thinking, I had assumed that client value, strategy, LPM, and pricing professionals were wide spread at the director or officer level.

For the first time this year, Altman Weil asked about these positions, leading to the chart above. It shows the percent of responding firms with such positions. If we round a bit, the percentage barely breaks one-third for the most popular position of client relations and value. Across all positions, the penetration is much lower than I had expected.

What should we make of these results? One possibility is that the respondents do not represent the market. The respondents include seven firms with more than 1,000 lawyers, 17 with between 500 and 999, and 23 with 250 to 499 lawyers. I suspect that a focus only on firms of more than 500 lawyers would show higher percentages.

If that’s right and if we assume that these positions add value for both clients and firms, then this finding is another reason we should worry about mid-size firms. Many commentators have explained why firms at that size face risks unless they have clearly defined market niches. For a recent and very thoughtful assessment of these risks, see a piece published Sunday, 28 June 2020, by Dan Currell at the Legal Evolution blog, The Great Unbundling.

Concluding Thoughts

I conclude from these data that firms do see a need for change but that acting on that recognition remains a big challenge. And that should not surprise us. We know the challenges of any change management. And, as I have observed in my blog previously, firms appear to be changing as fast as clients actually want (versus what they might say they want). Of course, I likely suffer from confirmation bias so take my conclusions with a grain of salt.

Archives

Blog Categories

- Alternative Legal Provider (44)

- Artificial Intelligence (AI) (57)

- Bar Regulation (13)

- Best Practices (39)

- Big Data and Data Science (14)

- Blockchain (10)

- Bloomberg Biz of Law Summit – Live (6)

- Business Intelligence (21)

- Contract Management (21)

- Cool Legal Conferences (13)

- COVID-19 (11)

- Design (5)

- Do Less Law (40)

- eDiscovery and Litigation Support (165)

- Experience Management (12)

- Extranets (11)

- General (194)

- Innovation and Change Management (188)

- Interesting Technology (105)

- Knowledge Management (229)

- Law Department Management (20)

- Law Departments / Client Service (120)

- Law Factory v. Bet the Farm (30)

- Law Firm Service Delivery (128)

- Law Firm Staffing (27)

- Law Libraries (6)

- Legal market survey featured (6)

- Legal Process Improvement (27)

- Legal Project Management (26)

- Legal Secretaries – Their Future (17)

- Legal Tech Start-Ups (18)

- Litigation Finance (5)

- Low Cost Law Firm Centers (22)

- Management and Technology (179)

- Notices re this Blog (10)

- Online Legal Services (64)

- Outsourcing (141)

- Personal Productivity (40)

- Roundup (58)

- Structure of Legal Business (2)

- Supplier News (13)

- Visual Intelligence (14)