This is a live post of a webinar hosted by Advance Law.

In July, An Open Letter From 25 General Counsel published in Corporate Counsel announced a ” real-time exercise to test industry assumptions and understand how to improve the legal market and relationships between law firms and clients. Led by general counsel from Panasonic, Mastercard, Avaya, Pernod Ricard, PayPal, Flex, Keurig Green Mountain, Petco, Molson Coors, Becton Dickinson, Peabody Energy, TriMas, Rockwell Automation, DXC, Sony Electronics, and several others.” It explained the GC are working with Advance Law

This is a live post of and Advance Law webinar that presents initial findings of the exercise, so please forgive typos and any misunderstandings of meaning.

[Update of 10 Sep 2017, 8:00pm: I have received reviewed and final slides of this webinar from Advance Law and re-inserted the updated versions. In this update, I have also correct grammatical errors and clarified meaning but not made any substantive changes from the original.]

Update of 7 Sep 2017, 1:45pm: At the request of Advance Law, I have removed sides of the preliminary findings from the early-look study. Advance Law will update slides in the future and, when I receive those, I will re-insert them here.]

WEBINAR REPORT

Introduction by Firoz Dattu, Founder and CEO of Advance Law

Firoz Dattu explains why Advance Law is conducting this study. Firoz has been working with GCs for 20 years. In all his conversations, he never came away with the idea that law firms are not open to innovating. So it leaves open the question of what impedes innovation. The reason is that performance information does not transmit in the market. Also, law firms are funded as partnerships, which can slow down innovation.

But an even bigger impediment is that GCs are not monolithic. An innovation can exite half the GCs – but turn off the other half. So true change may not happen because innovation does not always work. Also, there is an “aspiration gap”

GCs said to law firms “showcase your innovation more”. But firms were saying “you don’t really want to hear”

So the thought leader experiment is about figuring out what innovations really work. The goal is to move from gut instinct and anecdote about which innovations work to a data driven approach. Advance Law believes that solutions have to be mutually beneficial; the goal is to improve the entire profession.

What is Advance Law (AL)?

A group of 180 GCs. AL works with in-house teams to vet law firms and ID outside firms. Firms vetted on basis of quality, innovation, efficiency, client service, diversity, attitude. AL collects formal feedback on all engagements and shares this among the group.

The Thought Leaders Experiment and Panelists

A group of forward thinking GCS are testing the efficacy of different relationship practices. References the open letter published (see reference at post opening).

The Panelists

Panel Self-Intros and Why GC Panelists are Involved in Thought Experiment

Reichert (Molson Coors): the struggle is where to innovate. Our company has to innovate regularly. So we as a law department want to work with our outside partners to understand what works and does not work with respect to innovation. Within our department, we want to innovate but we are not monolithic. So we want to learn what works elsewhere.

Walcott (PayPal): I am relatively new – 7 months – at PayPal. I am passionate about the work here. In-house counsel are best positioned to drive change in the legal market. A collective approach is really important.

Offer (Flex): We expect firms to be not just lawyers, but also business partners. To be trusted advisor, a law firm has to hit a lot of credibility and reliability notes. Interests most be aligned. Technical expertise is not enough. Intimacy and shared self-interest are key.

Deckelman (DXC): This is about service quality and innovation. We are at a point of inflection in the market. Business is now in a position to take advantage of new tech and digitization that will finally bring real change to legal services. But at same time, we face cost pressure. We need firms to help us tech-enable our joint practices. I see several firms get it and understand it and implement these changes. We want to work with more of these firms.

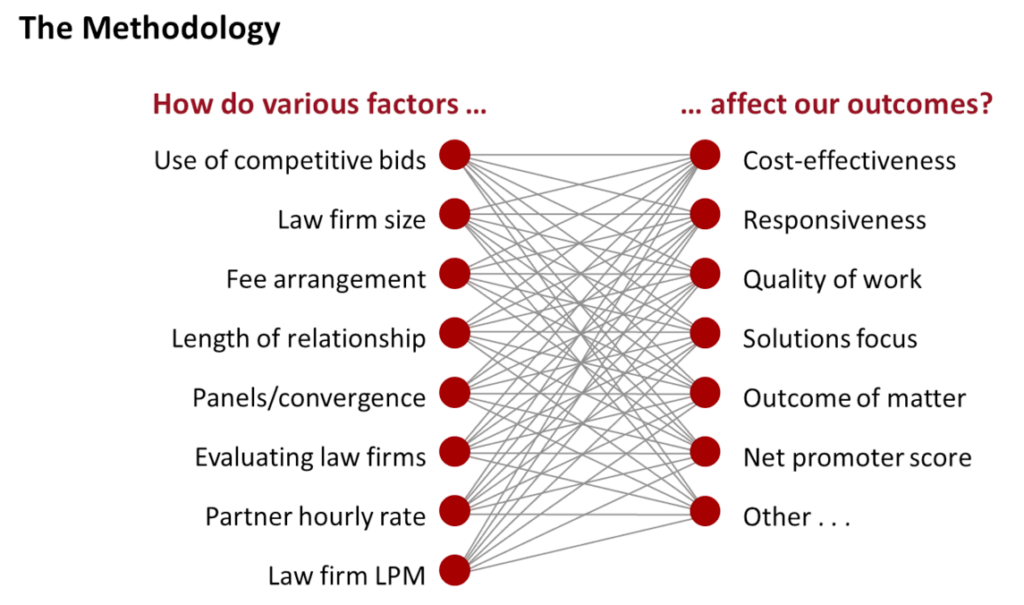

The Methodology

The Thought Experiment is looking at a range of factors and how they affect outcomes. This is not benchmarking study. This is a root cause study: when good things happen, what drove that and can we reproduce it?

Questions to Discuss

- Do law firm panels work?

- What are effective engagement tools?

- How helpful are law firm evaluations

- Is there a trade-off between cost and quality

- Do flat fees impact service quality

There are other hypotheses to test (quite a few) but the above have enough initial data to begin discussing. The caveat here is that the study is 8 months into an 18 month data collection process. So findings here are preliminary and directional. The numbers will change – but the findings are directionally correct.

More findings – with stats – to be published regularly.

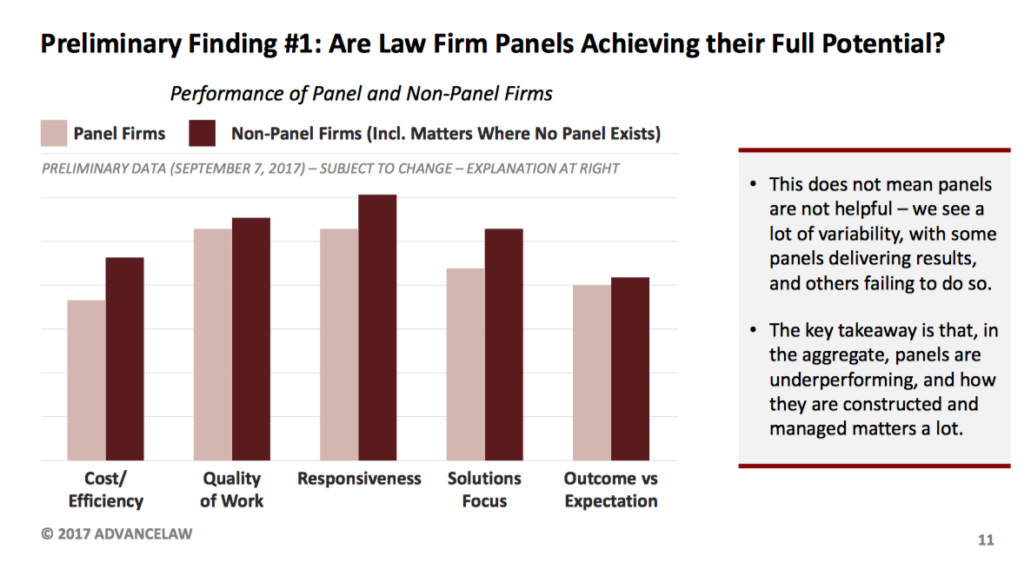

Finding 1: Do Law Firm Panels Work?

A surprise here: the panel firms do worse than non-panel firms. Caveates here are that there is a lot of variability. Key takeaway is that panels don’t always work. They work only if properly managed. The experiment is now looking at what drives panel success, where they do succeed.

Deckleman Comments: DXC established a panel this year post its mergers. We look at panel firms as strategic partners. We are identifying upfront where the opportunities are and who inside and at the firm must interact – establish the right connections. Panel is not just about lowering fees – we want that but passion about client responsiveness and being able to support us in a deep way. We have gone beyond our incumbent firms that fit what we now want. Many of our firms are in the AL panel – not necessarily in traditional size brackets or geographic locations. We are getting high quality at effective rates. With AL, we are regularly evaluating firms – this is key to keep relationship dynamic. We are taking steps to keep competition injected in the process (so that we don’t end up with typical incumbency problems).

PayPal does not currently have a panel. GC’s initial thinking was that the company would need a panel. But this finding this suggests that forming a panel is first step in a process, not the last. So to move forward with a panel is a process that requires cultivating relationships and foster business intimacy. The panel needs to be about value-add, not just cost savings.

Flex – panels need to be managed. We look to AL for guidance on how to manage panels. We’ve had good experiences with panels with some exceptions. This helps us up our game.

Firoz – one issue we see frequently is that panels are overweighted to one type of firm. Panels can work but take active management. “A lot of potential but avoid the pitfalls”

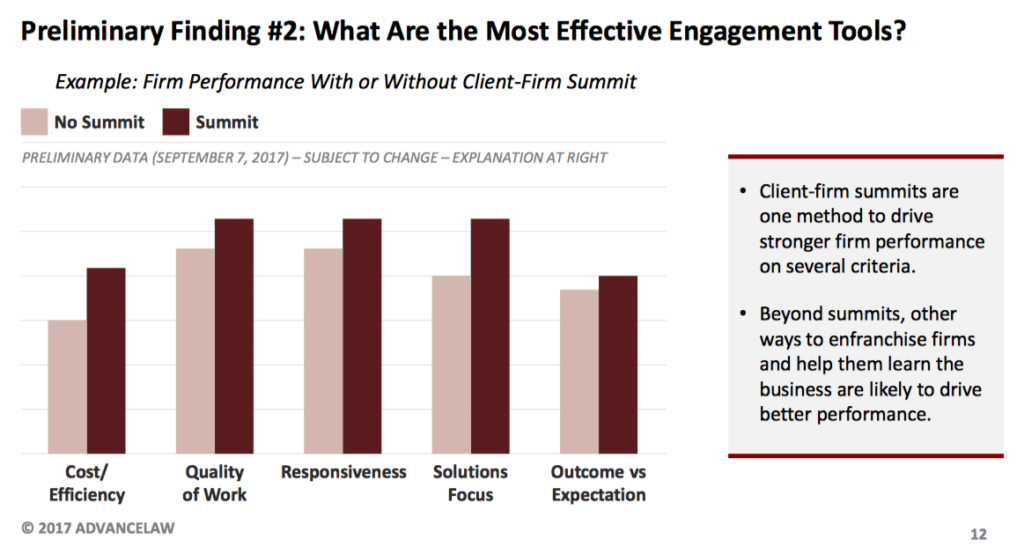

Finding 2: What are Some Effective Engagement Tools?

Look at one particular approach: a law firm summit

For law departments that regularly convene summits, performance is better. Summits are, in a sense a proxy for other tools that can improve intimacy (ability of law firm to know the client and its industry).

GC Comments:

- We invite lawyers to sit with us to learn our business, to work in our offices, even if not on our matters. Being present is an experiment. Final results not in but we see so far that it gives outside lawyers a chance to sit-in on meetings that they would otherwise not be part of.

- Secondments are helpful

- Summits are a great way for outside lawyers to learn our business. It also allows our multiple outside counsel to get to know each other. Breaks down some silos and develops personal relationships across firms – which helps with connectivity.

- It’s key to make sure in-house lawyers understand the need to invest time and energy in the Summits.

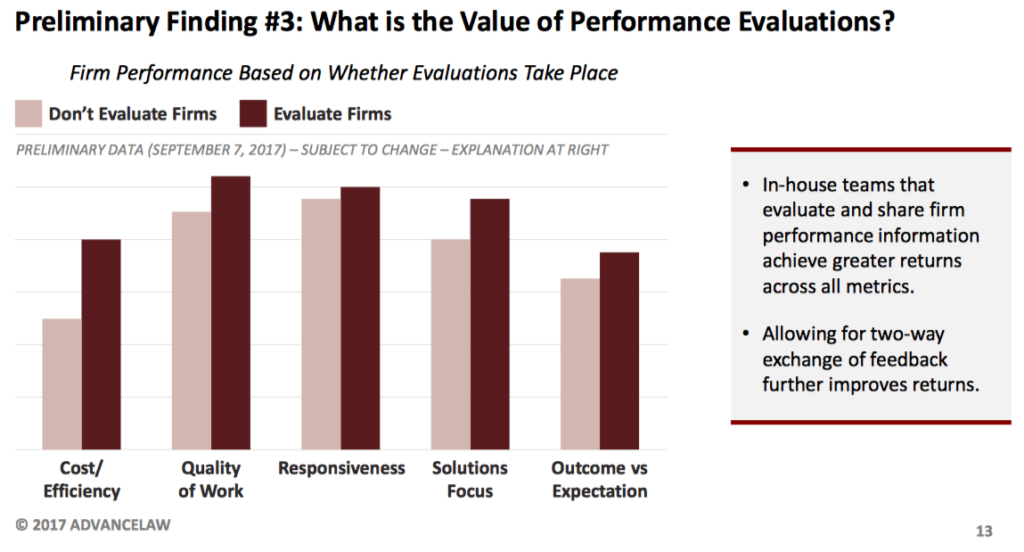

Finding 3: How Helpful are Law Firm Evaluations?

Many GCs do not systematically evaluate outside counsel. But the data show that doing so – at least managed correctly – improves performance. Evaluations stave off complacency and provide a roadmap for improvements.

GCs Comment:

- PayPal: beyond the obvious benefit of feedback at the end of significant matter (and asking for feedback)… I’ve seen in prior jobs in sharing evaluations with firms. Evaluations serve to give appropriate credit and recognition to those doing the actual work. Those on receiving end of feedback can gain recognition in their firms – this helps them. This is especially and important driver for diversity.

- Flex: I rarely get senior law firm partners asking me “how are we doing”. I’ve always found that odd. It’s a strange cultural artifact that law firms don’t ask.

- DXC: I have seen the same lack of asking. We will use AL to use the one-page scorecard – make evaluation sustainable and not just ad hoc. That will help both sides.

Firoz: we will also provide guidance on how to make it easier / safer for firms to give feedback to firms

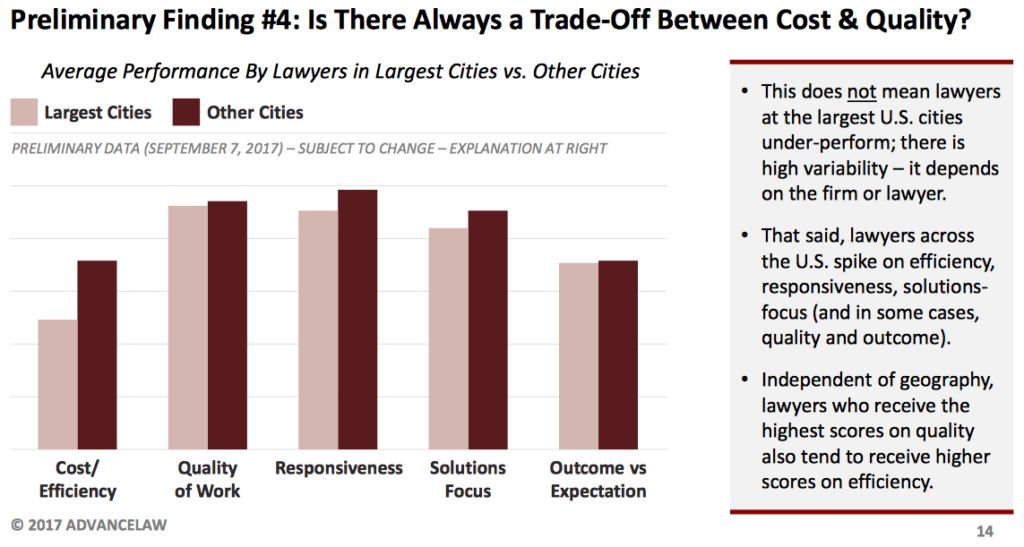

Finding 4: Is There a Trade-Off Between Cost and Quality?

Conventional wisdom is that there is deeper talent and better performance from big city lawyers. Data show otherwise.

Variance within a metro area is huge. But in aggregate, there is an opportunity for ‘near-shoring” (using lawyers in smaller, nearby cities). You can find A-team lawyers in many locations,

GC Comments:

- Molson Coors: Internally, we’ve discussed this at length. This finding validates some of our hypotheses that we can find great lawyers in lower tier cities if you select wisely. As we can continue, we will likely expand the size and location of firms we consider

- Another concurs.

Firoz – no data page for this but we pored through individual lawyer evaluations. We found that lawyers who did best on quality also did best on efficiency, across both small and large cities. This comports with eight years of AL data.

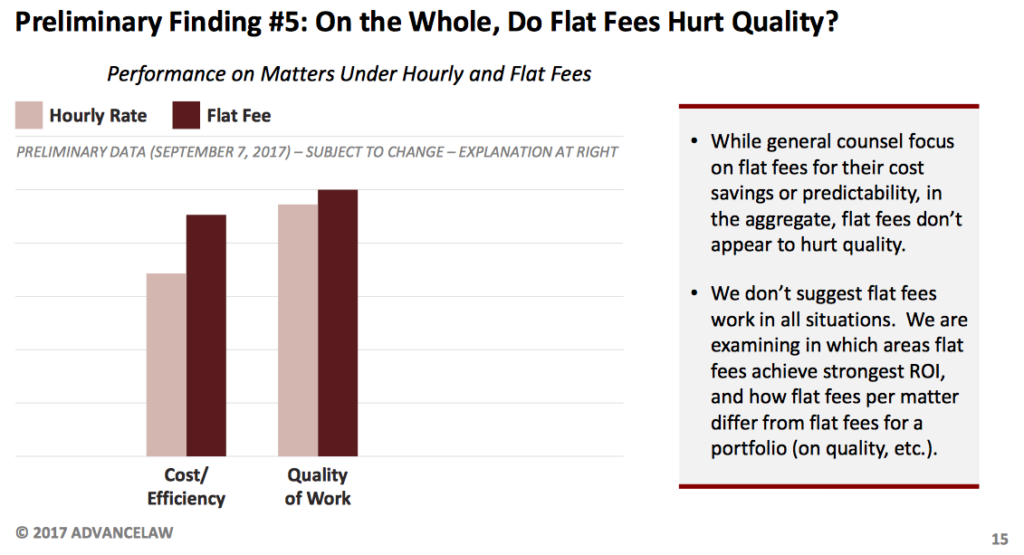

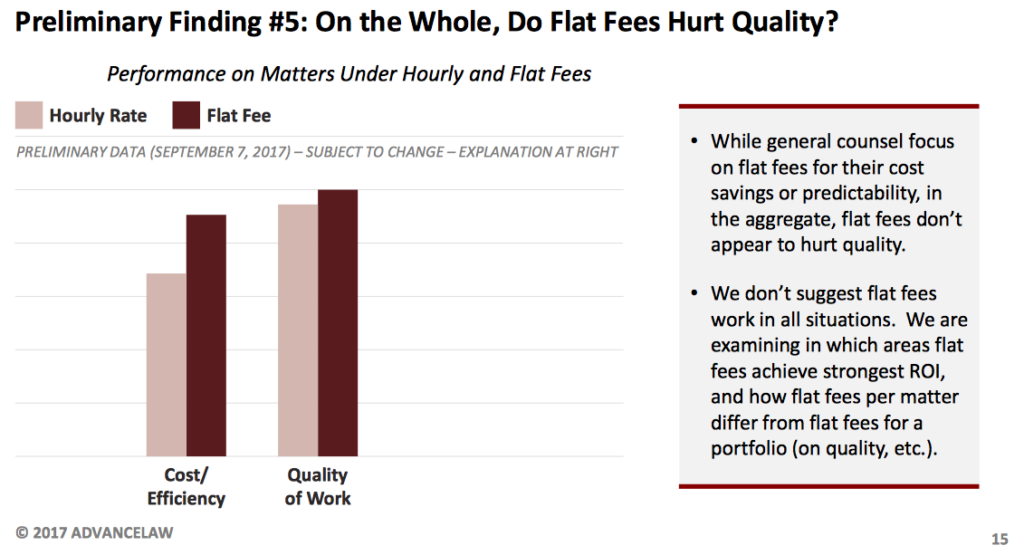

Finding 5: Do Flat Fees Impact Service Quality?

Flat fees perform better on cost and efficiency and are closely matched on quality. There is a lot of variance in performance.

Final Words

- Look forward to continue dialog. Learned a lot already

- This starts an ongoing dialog. It’s great that we have this data – and the questions that they raise that we can explore with data.

- Exciting time in legal market. This gives some optimism.

- Inhouse lawyers need to be trusted business advisors. We need closer law firm relationships. What we see here will modernize the relationship

Archives

Blog Categories

- Alternative Legal Provider (44)

- Artificial Intelligence (AI) (57)

- Bar Regulation (13)

- Best Practices (39)

- Big Data and Data Science (14)

- Blockchain (10)

- Bloomberg Biz of Law Summit – Live (6)

- Business Intelligence (21)

- Contract Management (21)

- Cool Legal Conferences (13)

- COVID-19 (11)

- Design (5)

- Do Less Law (40)

- eDiscovery and Litigation Support (165)

- Experience Management (12)

- Extranets (11)

- General (194)

- Innovation and Change Management (188)

- Interesting Technology (105)

- Knowledge Management (229)

- Law Department Management (20)

- Law Departments / Client Service (120)

- Law Factory v. Bet the Farm (30)

- Law Firm Service Delivery (128)

- Law Firm Staffing (27)

- Law Libraries (6)

- Legal market survey featured (6)

- Legal Process Improvement (27)

- Legal Project Management (26)

- Legal Secretaries – Their Future (17)

- Legal Tech Start-Ups (18)

- Litigation Finance (5)

- Low Cost Law Firm Centers (22)

- Management and Technology (179)

- Notices re this Blog (10)

- Online Legal Services (64)

- Outsourcing (141)

- Personal Productivity (40)

- Roundup (58)

- Structure of Legal Business (2)

- Supplier News (13)

- Visual Intelligence (14)