This week Altman Weil released its 2014 Chief Legal Officer Survey. It confirms the buying power of general counsels remains strong. The survey presents a range of interesting results. I call your attention to two findings that explain the price pressure that Big Law face.

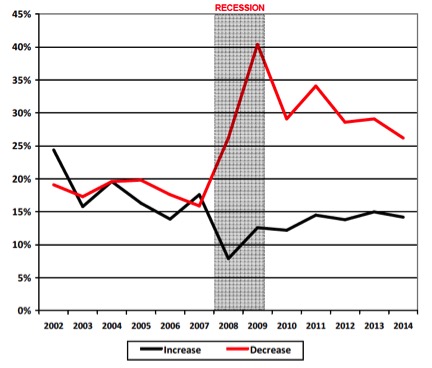

From 2002 to 2008, the percent of CLOs increasing and decreasing their use of law firms tracked each other closely. In the economic crash, the lines diverged (from page 5 of survey):

Use of Outside Counsel 2002-2014

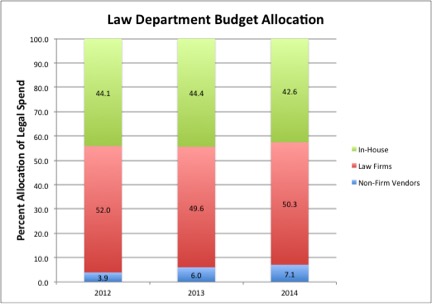

The impact of this trend (data at page 21) shows clearly in the share of corporate legal spend going to law firms:

The shifts do not look dramatic when displayed in the 100% bar view but note that law firms have lost two percentage point share of spend in two years. And non-law firm alternatives, which includes e-Discovery, document review, due diligence, and legal research, has almost doubled its share in two years.

Other data from this week show the supply side – that is, lawyer headcount at Big Law – continues to grow. The TRI Peer Monitor Index Report for Q3 (pdf) notes that

“since Q3 2013, headcount growth has been steadily rising, reaching its highest level since Q4 2012. Firms continue to add headcount ahead of demand. In fact, in recent quarters, headcount growth has more than cancelled out growth in demand, dampening productivity and profitability.”

We have Economics 101 here: buyers (CLOs) shift their dollars to in-house work and alternatives while suppliers (law firms) increase capacity. No wonder Altman Weil found discounting law firm rates rampant.

Is it time for law firms to take a lesson from the airline industry – cut capacity?

Archives

Blog Categories

- Alternative Legal Provider (44)

- Artificial Intelligence (AI) (57)

- Bar Regulation (13)

- Best Practices (39)

- Big Data and Data Science (14)

- Blockchain (10)

- Bloomberg Biz of Law Summit – Live (6)

- Business Intelligence (21)

- Contract Management (21)

- Cool Legal Conferences (13)

- COVID-19 (11)

- Design (5)

- Do Less Law (40)

- eDiscovery and Litigation Support (165)

- Experience Management (12)

- Extranets (11)

- General (194)

- Innovation and Change Management (188)

- Interesting Technology (105)

- Knowledge Management (229)

- Law Department Management (20)

- Law Departments / Client Service (120)

- Law Factory v. Bet the Farm (30)

- Law Firm Service Delivery (128)

- Law Firm Staffing (27)

- Law Libraries (6)

- Legal market survey featured (6)

- Legal Process Improvement (27)

- Legal Project Management (26)

- Legal Secretaries – Their Future (17)

- Legal Tech Start-Ups (18)

- Litigation Finance (5)

- Low Cost Law Firm Centers (22)

- Management and Technology (179)

- Notices re this Blog (10)

- Online Legal Services (64)

- Outsourcing (141)

- Personal Productivity (40)

- Roundup (58)

- Structure of Legal Business (2)

- Supplier News (13)

- Visual Intelligence (14)